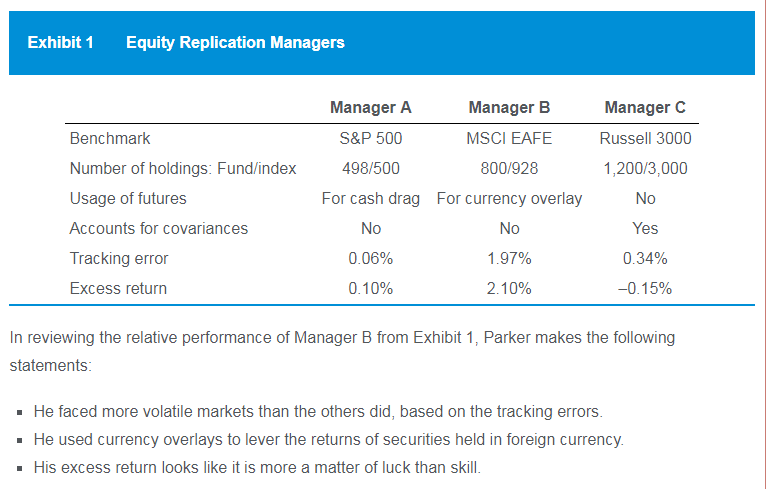

Q. Which of Parker’s statements about Manager B in Exhibit 1 is most appropriate? The statement about:

- tracking errors.

- excess return.

- currency overlays.

Solution

B is correct. The comment about excess return being luck rather than skill is correct. Replication managers attempt to create a portfolio that tracks the performance and the volatility of the underlying index as closely as possible. The proper measure of skill is the tracking error: Manager B has the highest tracking error among the three managers.

A is incorrect because tracking error does not measure volatility of the portfolio; rather, it measures the volatility of the excess return between the index and the portfolio.

C is incorrect because a currency overlay assists a portfolio manager in hedging (not levering) the returns of securities that are held in foreign currency back to the home country’s currency.

Passive Equity Investing Learning Outcome

- Discuss potential causes of tracking error and methods to control tracking error for passively managed equity portfolios

此题答案说currency overlays是hedging not levering the return,我记得overlay是分割了hedging和寻求return的目标,currency overlay主要是追求收益的吧,然后future本身有levering的作用。

另外有几个equity问题在答题区有追问,请关注一下