题目:

An equity index is established in 2001 for a country that has relatively recently established a market economy. The index vendor constructed returns for the five years prior to 2001 based on theinitial group of companies constituting the index in 2001.

Over 2004 to 2006 aseries of military confrontations concerning a disputed border disrupted the economy and financial markets. The dispute is conclusively arbitrated at the end of 2006. In total, ten years of equity market return history is available as of the beginning of 2007.

The geometric mean return relative to 10-year government bond returns over 10 years is 2 percent per year. The forward dividend yield on the index is 1 percent. Stock returns over 2004 to 2006 reflect the setbacks but economists predict the country will be on a path of a4 percent real GDP growth rate by 2009.

Earnings in the public corporate sectorare expected to grow at a 5percent per year real growth rate. Consistent with that, the market P/E ratio is expected to grow at 1 percent per year.

Although inflation is currently high at 6 percent per year, the long-term forecast is for an inflation rate of 4 percent per year. Although the yield curve has usually been upward sloping, currently the government yield curve is inverted;at the short-end, yields are 9 percent and at 10-year maturities, yields are 7percent.

In the current interest rate environment, using a required return estimate based on the short-term government bond rate and a historical equity risk premium defined in terms of a short-term government bond rate would be expected to:

A supply side estimate of the equity risk premium as presented by The Ibbotson Chen earnings model is closest to:

A 3.2 percent.

B 4.0 percent.

C 4.3 percent.

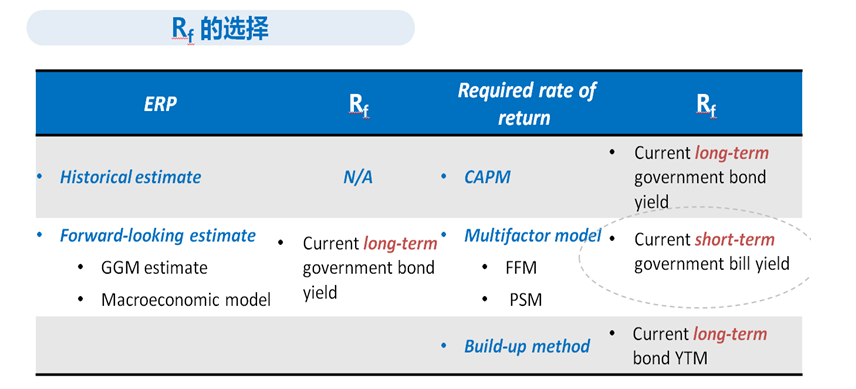

我记得在京电梯中老师有腔调强调:1,在GGM模型中,rf用长期;但是在哪个模型中要用短期(我忘了,也找不到相对应讲课的那个视频),能否请老师帮忙回忆一下?2,另外是否这道题可以当作结论,在计算s

upply side estimate of the equity risk premium用的是长期的rf。请老师帮忙回答上述两个问题,多谢!