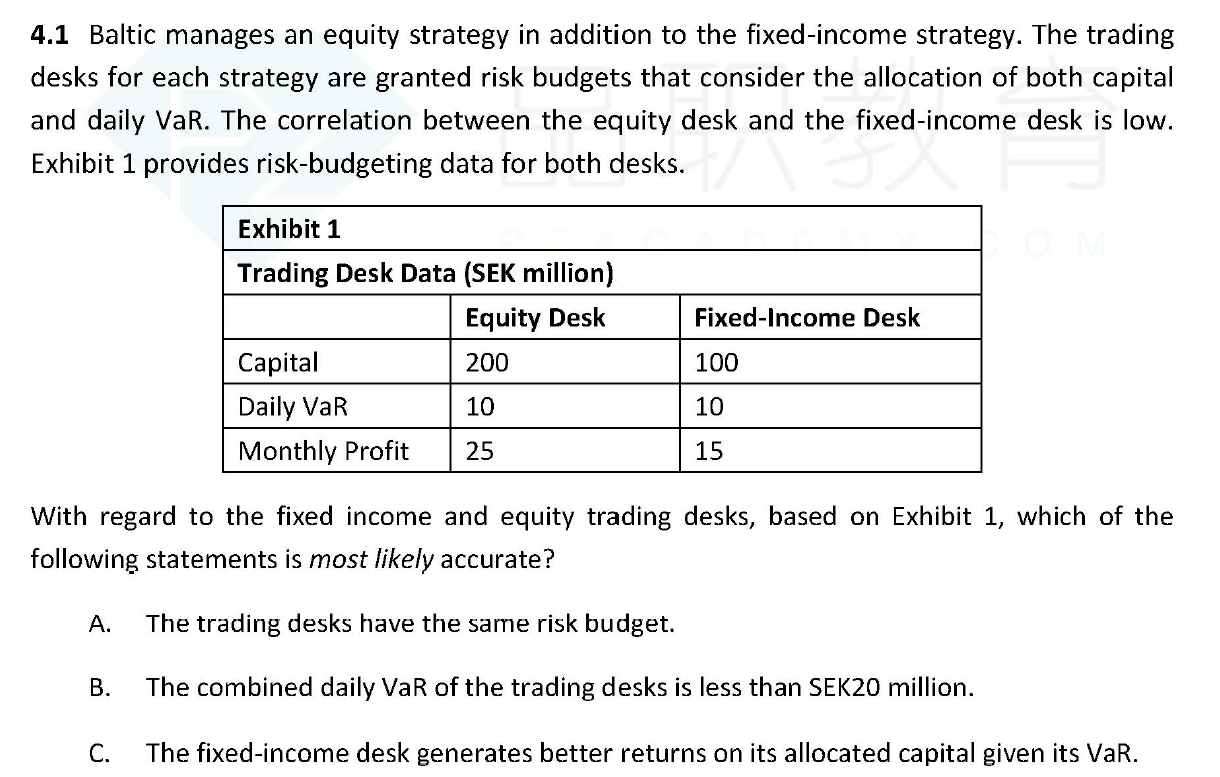

第一个问题,选项A问题

刚查了一遍教材原文“

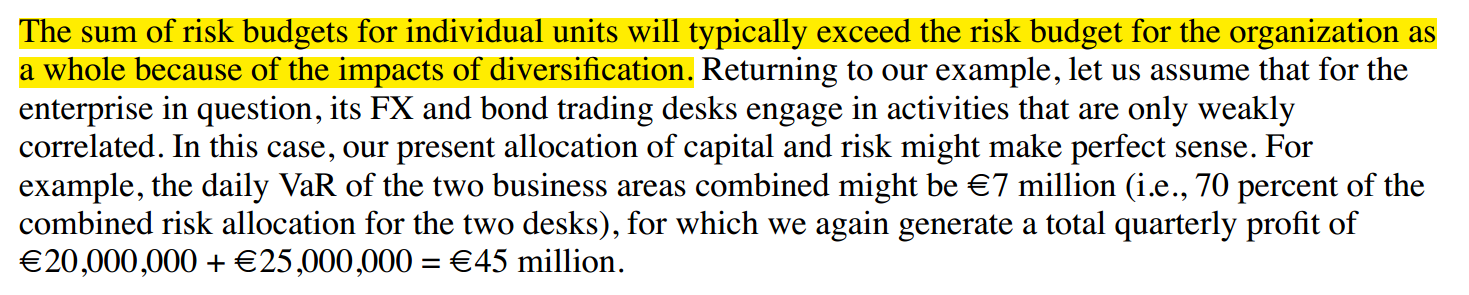

. So, to continue our example from above, say the FX trading desk made a quarterly profit of €20 million from its allocation. The bank’s fixed-income trading desk was allocated capital of €200 million and permitted a daily VaR of €5 million; the fixed-income trading desk made €25 million in quarterly trading profits. We note that the allocated daily VaRs for the two business areas are the same, so each area has the same

risk

budget

(Institute 182)

原文例子一个fx trading desk 一个 fixed income desk var都是 5m,所有有“same risk budget”和此题A选项一样,为什么不选A呢?

第二个问题,选项B问题

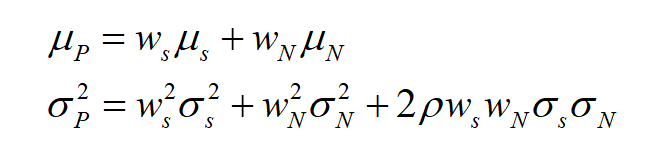

组合VAR如何计算,怎么看相关系数小,组合VAR就比两个VAR加起来小?

第三个问题,组合方法举例

另外我对两个资产组合方差和相关系数关系问题遗忘了,我记得好像相关系数不等于1就有分散风险作用,假设一个资产标准差10%,另一个20%,相关系数0.1,可否根据计算解释一下?

”