问题如下图:

选项:

A.

B.

C.

解释:

包包_品职助教 · 2019年04月03日

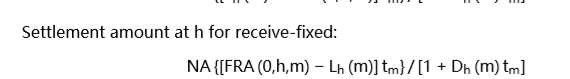

同学你好,其实settlement 和Value的本质区别不是用哪一种方法算,而是value说的是估值,但是settlement说的是交割,估值我们一般就是在FRA到期前的任意时刻都可以求估值,而settlement则是发生在FRA到期的时刻。在T时刻,就是FRA到期的时候,求交割,我们就用(FRA-libor)乘以本金再折现。相当于我们签订了FRA,我们收到FRA乘以本金这么多利息,不签订FRA我们收到libor乘以本金这么多利息,那么签订FRA交割的金额就是两者相减再折现(就相当于算签订FRA带给我们的好处)。原版书也给出了计算公式。

而对于求value,其实就是画现金流,然后用向上箭头减去向下箭头,这个推导过程有点复杂,我给你推到一下,我们原版书上给出的公式是Vg(0,h,m) = {[FRA(g,h−g,m)−FRA(0,h,m)]tm}/[1+Dg(h+m−g)th+m−g],对于long FRA的一方来说,value就等于当前时刻签订一份相同到期期限的FRA减去我们合约中约定的FRA再乘以本金再折现。对于这道题中,如果此时当前时刻的FRA是合理定价的话,我们根据计算FRA的方法可以算出来FRA=discount rate。对于这道题的short方来说,那带进去就是:但是注意,这个方法只适合FRA是合理定价的时候,如果FRA没有合理定价,就不可以用,只能用最根本的公式用。:

包包_品职助教 · 2019年04月01日

value就是根据当前市场利率用向上箭头减去向下箭头那样算的,因为本金那一笔本身就发生在FRA到期时刻,所以不用折现。你看下我下面的图片,我画了这笔业务的现金流,settle是根据到期时市场上FRA报价计算的,也就是两个FRA轧差去年化再乘以本金再折现。

陈Shelly · 2019年04月02日

老师,这个地方我还是没太明白。Value是用t时刻的NP减去NP乘以FRA到现在的折现,这个地方是用到了折现的;相对而言,settlement是 NP-NP乘以FRA整体的折现。这个区别到底为什么呢?李老师,课程视频里讲的是t时刻的settlement.

包包_品职助教 · 2019年04月03日

我说了这个过程,你看看

NO.PZ2019010402000015问题如下The company enters into a $100,000,000 notionamount 2 × 5 receive-fixeFRA this aanceset, aancesettle The appropriate scount rate for the FRA settlement cash flows is 1.5%. After 60 ys, 90-y Libor is 0.80%, 60-y Libor is 0.7%.If the FRA winitially price1.20%, the payment receiveto settle the 2 × 5 FRA will be:A.100,000B.99,626C.99,800B is correct.考点FRA settlement解析payment receive(1.2%−0.8%)×312×100,000,0001+1.50%×312=99,626.4payment\text{ }receive\frac{(1.2\%-0.8\%)\times\frac3{12}\times100,000,000}{1+1.50\%\times\frac3{12}}=99,626.4payment receive1+1.50%×123(1.2%−0.8%)×123×100,000,000=99,626.4注题目中特别说明了折现率是1.5%,所以直接用1.5%折现,不用90天的LIBOR折现。没有其他补充了,谢谢

NO.PZ2019010402000015问题如下The company enters into a $100,000,000 notionamount 2 × 5 receive-fixeFRA this aanceset, aancesettle The appropriate scount rate for the FRA settlement cash flows is 1.5%. After 60 ys, 90-y Libor is 0.80%, 60-y Libor is 0.7%.If the FRA winitially price1.20%, the payment receiveto settle the 2 × 5 FRA will be:A.100,000B.99,626C.99,800B is correct.考点FRA settlement解析payment receive(1.2%−0.8%)×312×100,000,0001+1.50%×312=99,626.4payment\text{ }receive\frac{(1.2\%-0.8\%)\times\frac3{12}\times100,000,000}{1+1.50\%\times\frac3{12}}=99,626.4payment receive1+1.50%×123(1.2%−0.8%)×123×100,000,000=99,626.4注题目中特别说明了折现率是1.5%,所以直接用1.5%折现,不用90天的LIBOR折现。这题的数给的有问题吧,公式应该是NA×[Lm-FRA0]×tm/(1+×tm),怎么会用1.2%-0.8%,应该用0.8%-1.2%

NO.PZ2019010402000015问题如下The company enters into a $100,000,000 notionamount 2 × 5 receive-fixeFRA this aanceset, aancesettle The appropriate scount rate for the FRA settlement cash flows is 1.5%. After 60 ys, 90-y Libor is 0.80%, 60-y Libor is 0.7%.If the FRA winitially price1.20%, the payment receiveto settle the 2 × 5 FRA will be:A.100,000B.99,626C.99,800B is correct.考点FRA settlement解析payment receive(1.2%−0.8%)×312×100,000,0001+1.50%×312=99,626.4payment\text{ }receive\frac{(1.2\%-0.8\%)\times\frac3{12}\times100,000,000}{1+1.50\%\times\frac3{12}}=99,626.4payment receive1+1.50%×123(1.2%−0.8%)×123×100,000,000=99,626.4注题目中特别说明了折现率是1.5%,所以直接用1.5%折现,不用90天的LIBOR折现。请问这题的头寸怎么看?根据FRA settlement的公式 不是应该当前的利率减FRA么?答案里面用FRA-当前利率

NO.PZ2019010402000015 问题如下 The company enters into a $100,000,000 notionamount 2 × 5 receive-fixeFRA this aanceset, aancesettle The appropriate scount rate for the FRA settlement cash flows is 1.5%. After 60 ys, 90-y Libor is 0.80%, 60-y Libor is 0.7%.If the FRA winitially price1.20%, the payment receiveto settle the 2 × 5 FRA will be: A.100,000 B.99,626 C.99,800 B is correct.考点FRA settlement解析payment receive(1.2%−0.8%)×312×100,000,0001+1.50%×312=99,626.4payment\text{ }receive\frac{(1.2\%-0.8\%)\times\frac3{12}\times100,000,000}{1+1.50\%\times\frac3{12}}=99,626.4payment receive1+1.50%×123(1.2%−0.8%)×123×100,000,000=99,626.4注题目中特别说明了折现率是1.5%,所以直接用1.5%折现,不用90天的LIBOR折现。 因为比较熟悉小t时刻求value时用重新定价法的,但是不太熟悉,settlement的折现,所以想confirm一下,Payment receive是折到贷款合约开始的时刻(即本题t=2时间点)?所以分母折现应该用90/360对吗?

NO.PZ2019010402000015问题如下 The company enters into a $100,000,000 notionamount 2 × 5 receive-fixeFRA this aanceset, aancesettle The appropriate scount rate for the FRA settlement cash flows is 1.5%. After 60 ys, 90-y Libor is 0.80%, 60-y Libor is 0.7%.If the FRA winitially price1.20%, the payment receiveto settle the 2 × 5 FRA will be:A.100,000B.99,626C.99,800B is correct.考点FRA settlement解析payment receive(1.2%−0.8%)×312×100,000,0001+1.50%×312=99,626.4payment\text{ }receive\frac{(1.2\%-0.8\%)\times\frac3{12}\times100,000,000}{1+1.50\%\times\frac3{12}}=99,626.4payment receive1+1.50%×123(1.2%−0.8%)×123×100,000,000=99,626.4注题目中特别说明了折现率是1.5%,所以直接用1.5%折现,不用90天的LIBOR折现。这一题为什么是用1.2%减去0.8%?