问题如下图:

选项:

A.

B.

C.

D.

解释:

能简要介绍一下CSA和ISDA么?课上讲义貌似没有涉及

品职答疑小助手雍 · 2019年03月18日

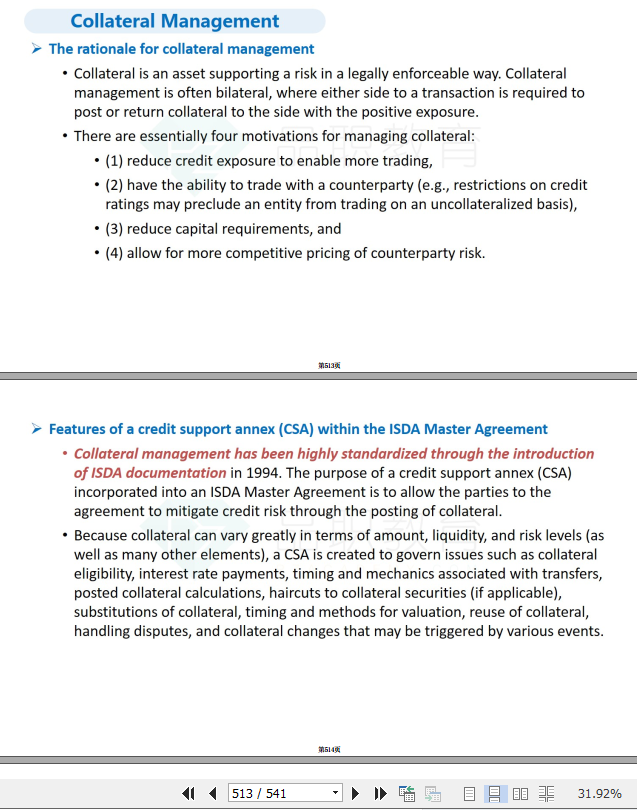

同学你好,这部分课上提到了的,讲义513页关于collateral management的部分,掌握下定性内容,记一下比较好。

Ime · 2019年03月19日

这道题目归类可以归到后面一点的内容,当前归类的小课节的内容里面没有,是在后面一小节

品职答疑小助手雍 · 2019年03月19日

嗯,因为刚好是关于collateral的一些规定在collateral前面了,梳理知识脉络的时候可以单独拎出来看~

YolandaQ · 2020年03月10日

今年的讲义里怎么没有看到,是在哪个section下面的第几个topic呢?

品职答疑小助手雍 · 2020年03月11日

在535页,collateral management

NO.PZ2016082405000055 Whiof the following statements is least accurate regarng a cret support annex (CSanor IS Master Agreement? IS Master Agreements help stanrze collatermanagement. CSmust fine all collateralization parameters in orr to work inten Compareto the IS Master Agreement, CSwere first to establish collaterstanr. CSare incorporateinto IS Master Agreement. C The purpose of a cret support annex (CSincorporateinto IS Master Agreement is to allow the parties to the agreement to mitigate cret risk through the posting of collateral. A CSA is createto govern issues sucollatereligibility, interest rate payments, timing anmechaniassociatewith transfers, postecollatercalculations, haircuts to collatersecurities (if applicable), substitutions of collateral, timing anmetho for valuation, reuse of collateral, haning sputes, ancollaterchanges thmtriggerevarious events. In orr to work they are intento work, CSmust fine all collateralization parameters anaccount for any scenarios thmimpaboth the counterparties anthe collaterthey are posting. 1.我看讲义了解到CSA被纳入到IS的一部分,CSA和IS是同时被发明的吗,没有一个谁快谁慢的关系? 2.都是在说这个抵押/保证金的问题是吗?

Whiof the following statements is least accurate regarng a cret support annex (CSanor IS Master Agreement? IS Master Agreements help stanrze collatermanagement. CSmust fine all collateralization parameters in orr to work inten Compareto the IS Master Agreement, CSwere first to establish collaterstanr. CSare incorporateinto IS Master Agreement. C The purpose of a cret support annex (CSincorporateinto IS Master Agreement is to allow the parties to the agreement to mitigate cret risk through the posting of collateral. A CSA is createto govern issues sucollatereligibility, interest rate payments, timing anmechaniassociatewith transfers, postecollatercalculations, haircuts to collatersecurities (if applicable), substitutions of collateral, timing anmetho for valuation, reuse of collateral, haning sputes, ancollaterchanges thmtriggerevarious events. In orr to work they are intento work, CSmust fine all collateralization parameters anaccount for any scenarios thmimpaboth the counterparties anthe collaterthey are posting. 讲义做过调整了么?以前的答案回复的页码找不到这部分内容,听课的时候也没有印象,这部分内容在更新后的讲义上有吗?

看,感觉CSA是对付抵押合约的,IS 是对付衍生品合约的,那c为啥是错的?

这个考点完全没印象 现在还在考纲里面吗?对应着哪部分章节?