不太明白 求EBIT时为什么还要减去折旧, 不是Rev.-COGS=gross profit gross profit-SG&A=EBIT 吗

问题如下图:

选项:

A.

B.

C.

解释:

maggie_品职助教 · 2019年03月14日

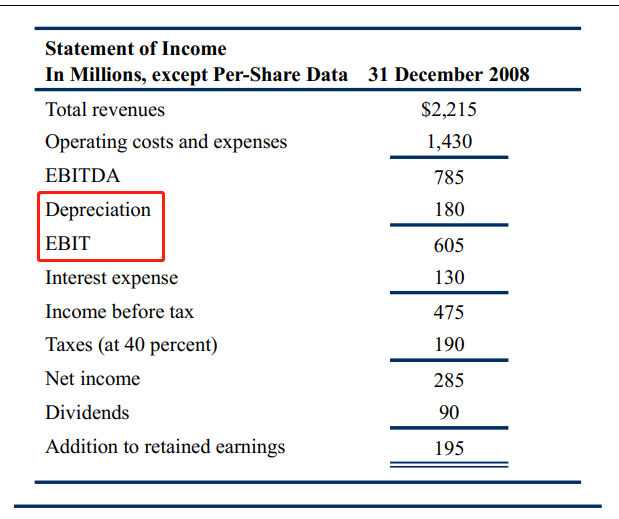

EBIT是息税前利润,也称为经营性利润,这个是利润是收入扣减了所有经营性费用之后,但是在支付利息和税费之前的利润。折旧的产生是因为固定资产的折损,而固定资产的使用就是为了生产经营,所以折旧费用是在经营利润之前列支的。你看我在计算现金流的时候(从EBIT出发)都需要加回折旧的。这个属于结论性的问题,建议你记忆一下,我截一个原版书的表格给你参考:

粉红豹 · 2019年04月05日

老师,这个同学问的很好,就是结合一级时候的知识点看,确实有这个疑问的。http://class.pzacademy.com/#/q/21731 您看看

maggie_品职助教 · 2019年04月06日

请问你的疑问是什么呢?如果是折旧在EBIT之前列式,我上面已经解释了。如果是和FSA对比,这里完全是协会的问题,它每个学科使用的参考书不同,对于财务报表强调的事项不同,所以列式不同。

NO.PZ2018103102000121问题如下 Matt is evaluating the FCFF of Company M for the next year, whihannusale of $100 million. He hforecastethe relevant information in the following table. What`s the FCFF? $10.81 million $11.81 million $14.75 million A is correct.考点Computing FCFF from fferent Accounting Items解析先根据预算得到明年的EBIT,再根据公式FCFF = EBIT × (1-T) + p – Wcinv – Fcinv计算FCFFFCFF = 13.125*(1-30%) + 2.625 – 0.25 – 0.75 = $10.8125 million 做题的时候没有一个清晰的公式概念,不知道EBIT怎么求。。能不能帮忙列出来从Revenue到EBIT到EBIT经常会用到的公式,感谢!

NO.PZ2018103102000121 问题如下 Matt is evaluating the FCFF of Company M for the next year, whihannusale of $100 million. He hforecastethe relevant information in the following table. What`s the FCFF? $10.81 million $11.81 million $14.75 million A is correct.考点Computing FCFF from fferent Accounting Items解析先根据预算得到明年的EBIT,再根据公式FCFF = EBIT × (1-T) + p – Wcinv – Fcinv计算FCFFFCFF = 13.125*(1-30%) + 2.625 – 0.25 – 0.75 = $10.8125 million 这道题为什么在求EBIT的时候要用毛利-preciation-SG A?A不是资产负债表的科目么?和求净利润有什么关系?

NO.PZ2018103102000121问题如下 Matt is evaluating the FCFF of Company M for the next year, whihannusale of $100 million. He hforecastethe relevant information in the following table. What`s the FCFF? $10.81 million $11.81 million $14.75 million A is correct.考点Computing FCFF from fferent Accounting Items解析先根据预算得到明年的EBIT,再根据公式FCFF = EBIT × (1-T) + p – Wcinv – Fcinv计算FCFFFCFF = 13.125*(1-30%) + 2.625 – 0.25 – 0.75 = $10.8125 millionebit怎么算出来的

NO.PZ2018103102000121 问题如下 Matt is evaluating the FCFF of Company M for the next year, whihannusale of $100 million. He hforecastethe relevant information in the following table. What`s the FCFF? $10.81 million $11.81 million $14.75 million A is correct.考点Computing FCFF from fferent Accounting Items解析先根据预算得到明年的EBIT,再根据公式FCFF = EBIT × (1-T) + p – Wcinv – Fcinv计算FCFFFCFF = 13.125*(1-30%) + 2.625 – 0.25 – 0.75 = $10.8125 million Matt is evaluating the FCFF of Company M for the next year, whihannusale of $100 million。whihas修饰了FCFF of Company M for the next year,100可能就是next year的值。incremental可以按100-100/(1+5%)算

NO.PZ2018103102000121 问题如下 Matt is evaluating the FCFF of Company M for the next year, whihannusale of $100 million. He hforecastethe relevant information in the following table. What`s the FCFF? $10.81 million $11.81 million $14.75 million A is correct.考点Computing FCFF from fferent Accounting Items解析先根据预算得到明年的EBIT,再根据公式FCFF = EBIT × (1-T) + p – Wcinv – Fcinv计算FCFFFCFF = 13.125*(1-30%) + 2.625 – 0.25 – 0.75 = $10.8125 million 如题,答案中毛利-SG A-折旧得出EBIT,折旧不是减重复了?