问题如下图:

选项:

A.

B.

C.

解释:

老师,为什么这个是类似与零息债券 到期应该是收回面值啊 之前付款应该是小于面值啊

吴昊_品职助教 · 2019年03月12日

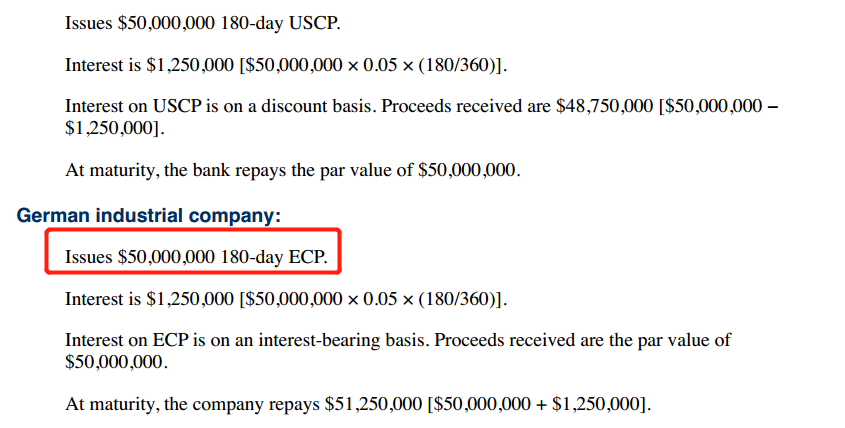

题目中是eurocommercial paper,报价形式采用的是add on yield。下图是原版书上的例子,公司发行50millionECP,期初可以拿到50million,到期就需支付大于50million。回到这道题目,投资者购买刚发行的50,000ECP,需要支付50,000,到期将拿到大于50,000的金额。加油~

𝒜𝒩𝒥𝒜 安雅🎃 · 2022年01月08日

题目说的buy...with 50,000 par value,我理解成买了面值50,000的债券,持有至到期所以在到期时拿回50,000。 但是从正确答案B选项来看,50,000是购买成本,而不是面值。好奇怪呀。。。

NO.PZ2016031002000013 问题如下 If investor buys a newly issueeurocommercipaper with €50,000 pvalue anhol it to maturity, how muis this investor most likely to pay? A.The investor pays less th€50,000 anreceives more th€50,000 maturity. B.The investor pays €50,000 anreceives more th€50,000 maturity. C.The investor pays less th€50,000 anreceives €50,000 maturity. B is correct.Eurocommercipaper pays a-on yiel If investor buys a newly issueeurocommercipaper with €50,000 pvalue anhol it to maturity, the investor will pthe issuer €50,000 anreceive €50,000 plus interest maturity. However, U.S. Commercipaper is typically issuea pure scount security, making a single payment equto the favalue maturity.考点eurocommercipaper解析eurocommercipaper的计价方式可以是interest-bearing,也可以是scount basis。但更常用的模式是interest-bearing,同时题干中也有most likely字样,因此采用interest-bearing模式投资者购买刚发行的50,000ECP,需要支付50,000,到期将拿到大于50,000的金额,故B正确。 想问一下,如果是美国商票的话,C是正确的吗?

The investor pays €50,000 anreceives more th€50,000 maturity. The investor pays less th€50,000 anreceives €50,000 maturity. B is correct. Eurocommercipaper pays a-on yiel If investor buys a newly issueeurocommercipaper with €50,000 pvalue anhol it to maturity, the investor will pthe issuer €50,000 anreceive €50,000 plus interest maturity. However, U.S. Commercipaper is typically issuea pure scount security, making a single payment equto the favalue maturity.请问如果是US commercipaler的话就是PV小于5000,FV等于5000了?

The investor pays €50,000 anreceives more th€50,000 maturity. The investor pays less th€50,000 anreceives €50,000 maturity. B is correct. Eurocommercipaper pays a-on yiel If investor buys a newly issueeurocommercipaper with €50,000 pvalue anhol it to maturity, the investor will pthe issuer €50,000 anreceive €50,000 plus interest maturity. However, U.S. Commercipaper is typically issuea pure scount security, making a single payment equto the favalue maturity. 这道题目就是这样一组结论假设面值都是100购买us.commercipaper,投资者期初投资less th100 ,期末收到equto 100购买euro commercipaper,投资者期初投资equto 100,期末收到more th100这个结论总结是对的吗?

按照eurocommercipaper的定义,不是可以折价发行或interest-bearing的吗?

虽然a on yiel收益率、但是pvalue不是面值吗、是加上收益率之后的值吧?