According to the solution shown above, isn't it based on the fact that the put has 3 years to expiration? But it actually only has 2 years to expiration.

According to the solution shown above, isn't it based on the fact that the put has 3 years to expiration? But it actually only has 2 years to expiration.

品职答疑小助手雍 · 2018年11月14日

同学你好,一般债券的期权,尤其是欧式,行权日都比到期时间要早,因为到期的价格都是par,期权对利率风险的控制作用就没有意义了,所以这里期权行权日比bond到期早一年,就是为了回避最后一年的利率风险。

旅人祈愿 · 2018年11月15日

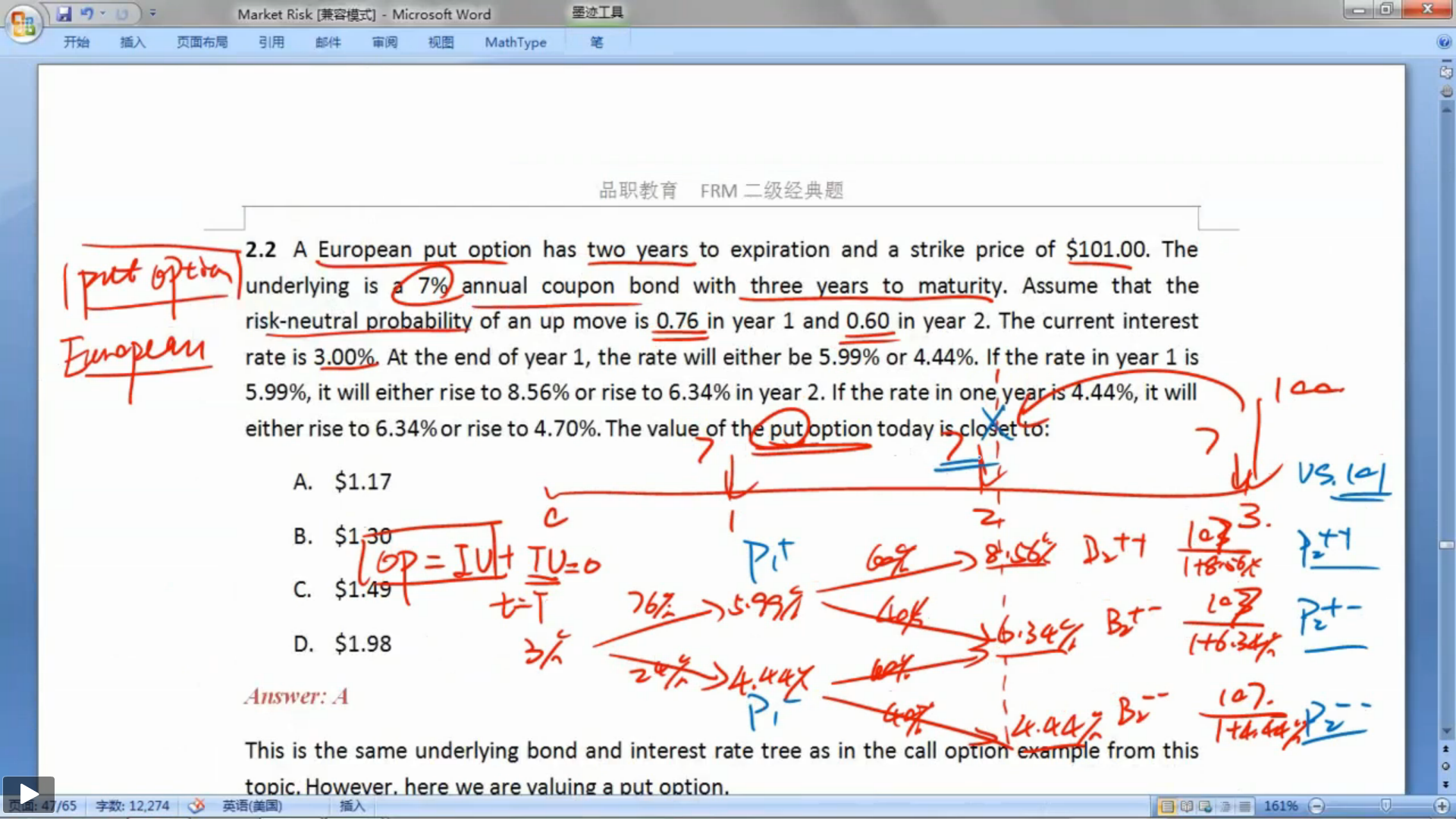

I understand that. So what I did was like: P2+=0.6*(B2++)+0.4*(B2+-)=99.386 P2-=0.6*(B2+-)+0.4*(B2--)=101.353 P1=(101-99.386)/1.0599*0.76=1.157 P0=1.157/1.03=1.124 Do you know which part is incorrect?