NO.PZ2019052001000141

问题如下:

Which of the following statements regarding the choice

of default probability approaches in computing economic capital is correct?

选项:

A.A through-the-cycle (TTC) approach should be used to

price financial instruments with credit risk exposure.

A point-in-time (PIT) approach is more commonly used

for computations involving profitability and strategic decisions.

A TTC approach is more likely to result in a lower

volatility of capital compared to the PIT approach.

A firm’s rating will not change when analyzed under

the PIT approach versus the TTC approach.

解释:

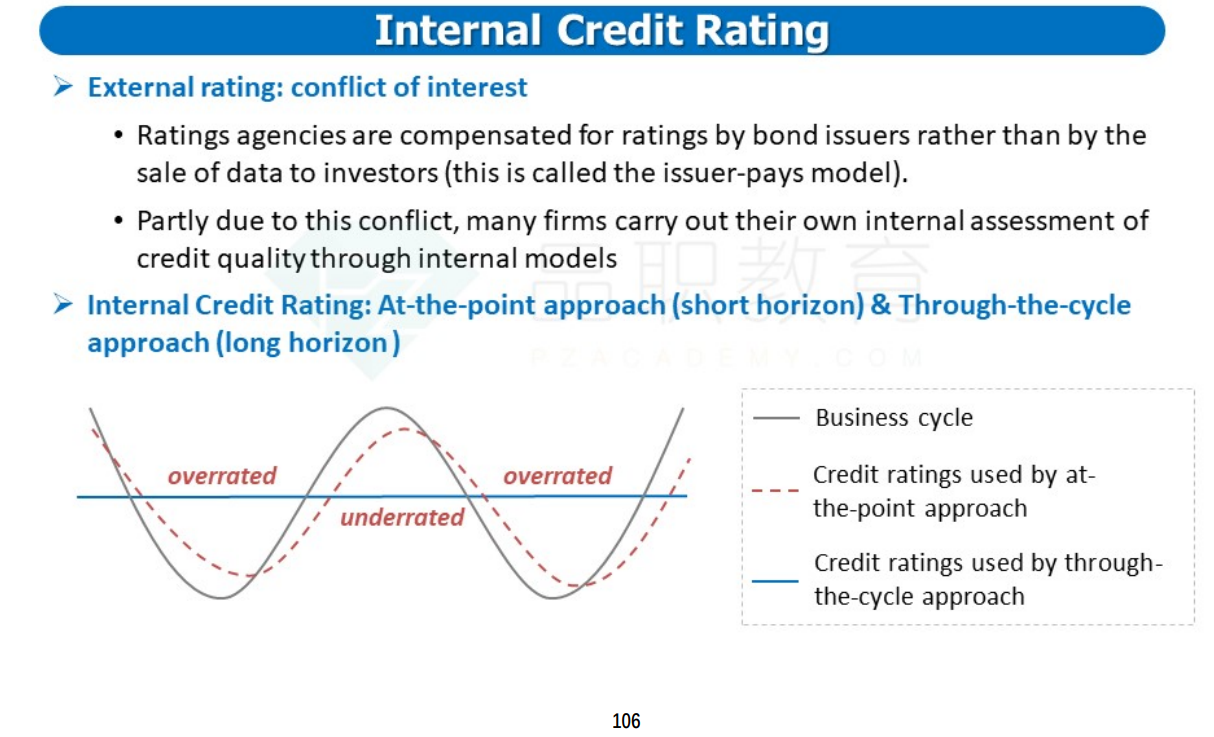

A firm’s rating is more likely to change when analyzed under the point-in-time (PIT) approach compared to the through-the-cycle (TTC) approach. As a result, the TTC approach results in a lower volatility of economic capital compared to the PIT approach.

A PIT approach should be used to price financial

instruments with credit risk exposure and to compute short-term expected

losses. A TTC approach is more commonly used for computations involving

profitability, strategic decisions, and economic capital.

如题