NO.PZ2023091601000034

问题如下:

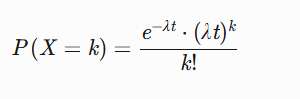

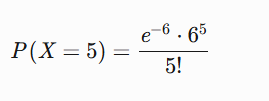

Anoperational risk manager uses the Poisson distribution to estimate thefrequency of losses in excess of USD 2 million during the next year. It isobserved that the frequency of losses greater than USD 2 million is three peryear on average over the last 10 years. Assuming that this observation isindicative of future occurrences and that the probability of one eventoccurring is independent of all other events, what is the probability of fivelosses in excess of USD 2 million occurring during the next two years?

选项:

A.

10.08%

B.

14.04%

C.

14.62%

D.

16.06%

用指数分布好像也不行,泊松分布无从下手