NO.PZ2023041004000099

问题如下:

McNeil asks Falk to gather spot and futures price data on live cattle, wheat, and soybeans, which are presented in Exhibit 1. Additionally, she observes that (1) the convenience yield of soybeans exceeds the costs of its direct storage and (2) commodity producers as a group are less interested in hedging in the forward market than commodity consumers are.

Based on Exhibit 1 and McNeil’s two observations, the futures price of soybeans is most consistent with the:

选项:

A.insurance theory.

B.theory of storage.

C.hedging pressure hypothesis.

解释:

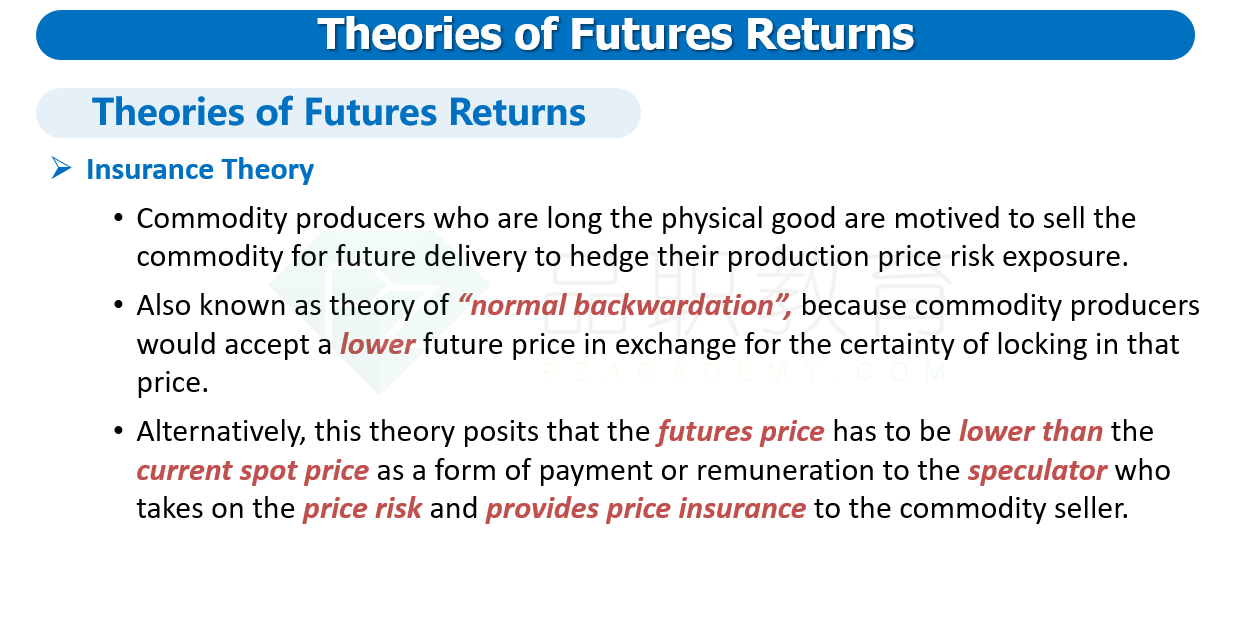

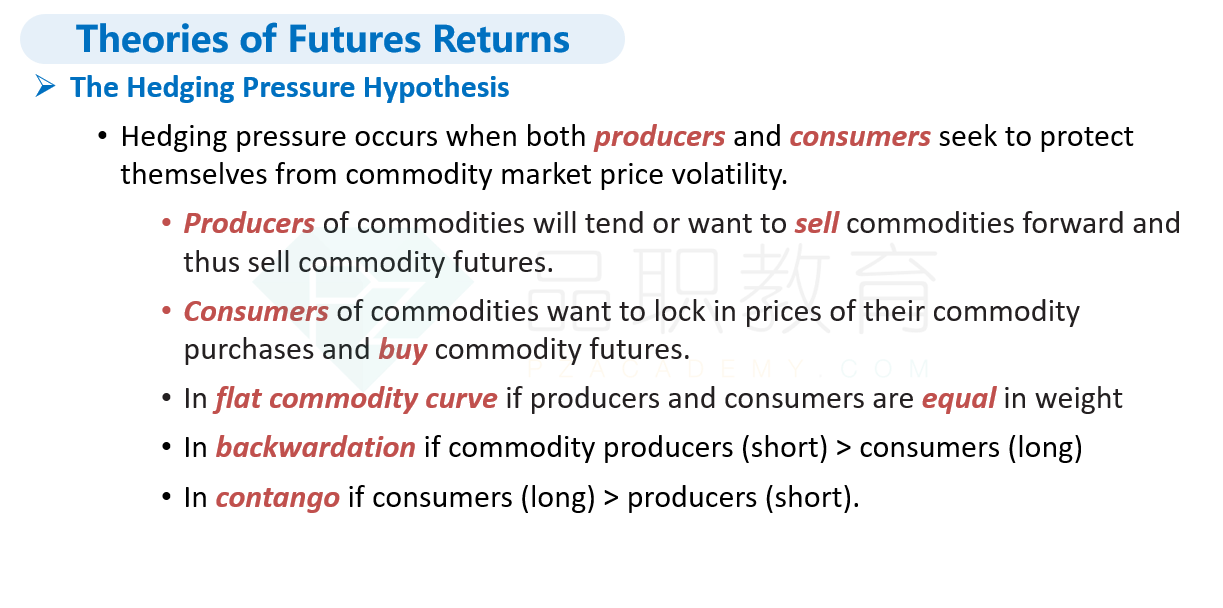

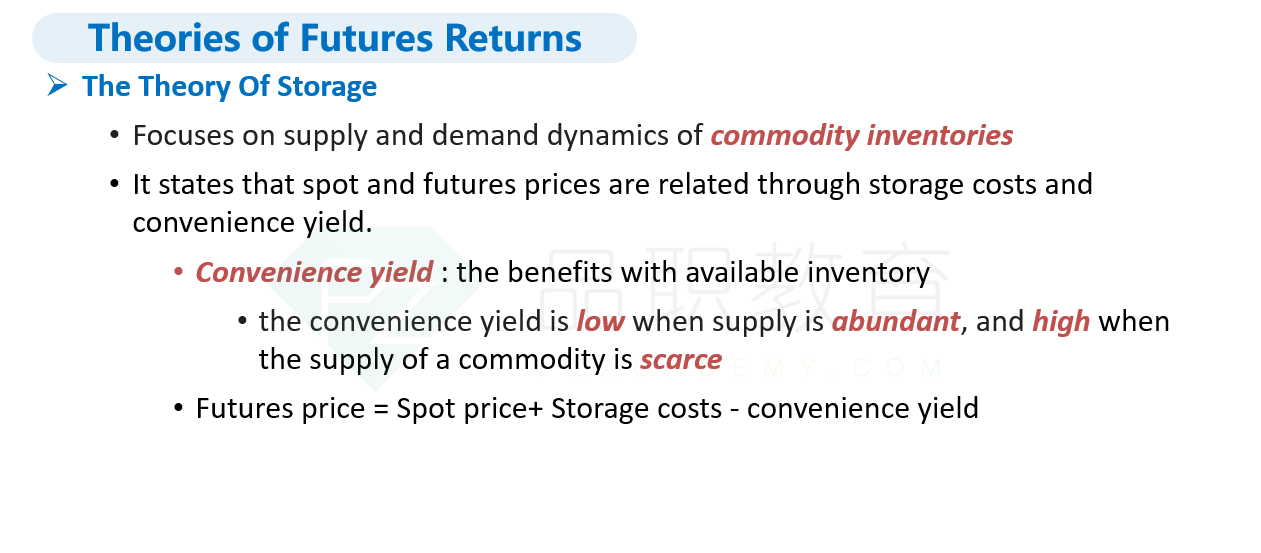

In Exhibit 1, the spot price of soybeans is less than the futures price. This observation can be explained only by the hedging pressure hypothesis. According to this hypothesis, hedging pressure occurs when both producers and consumers seek to protect themselves from commodity market price volatility by entering into price hedges to stabilize their projected profits and cash flows. If consumers are more interested in hedging than producers are, the futures price will exceed the spot price. In contrast, the insurance theory predicts that the futures price has to be lower than the current spot price as a form of payment or remuneration to the speculator who takes on the price risk and provides price insurance to the commodity seller. Similarly, the theory of storage also predicts that when a commodity’s convenience yield is greater than its direct storage costs, the futures price will be lower than the spot price.讲义里是不是没有这个理论