NO.PZ202405210200000205

问题如下:

Due to rising interest rates and the impact on the returns of fixed income in Country C, which of the following statements is most likely correct?

选项:

A.For horizons longer than the duration, the reinvestment impact will tend to dominate, so rising rates imply lower return.

B.Over horizons shorter than the duration, the capital gain/loss impact will generally dominate, so rising rates indicate lower return.

C.Over horizons shorter than the duration, the effect of any capital gain/loss impact dominates, so rising rates generally imply higher return.

解释:

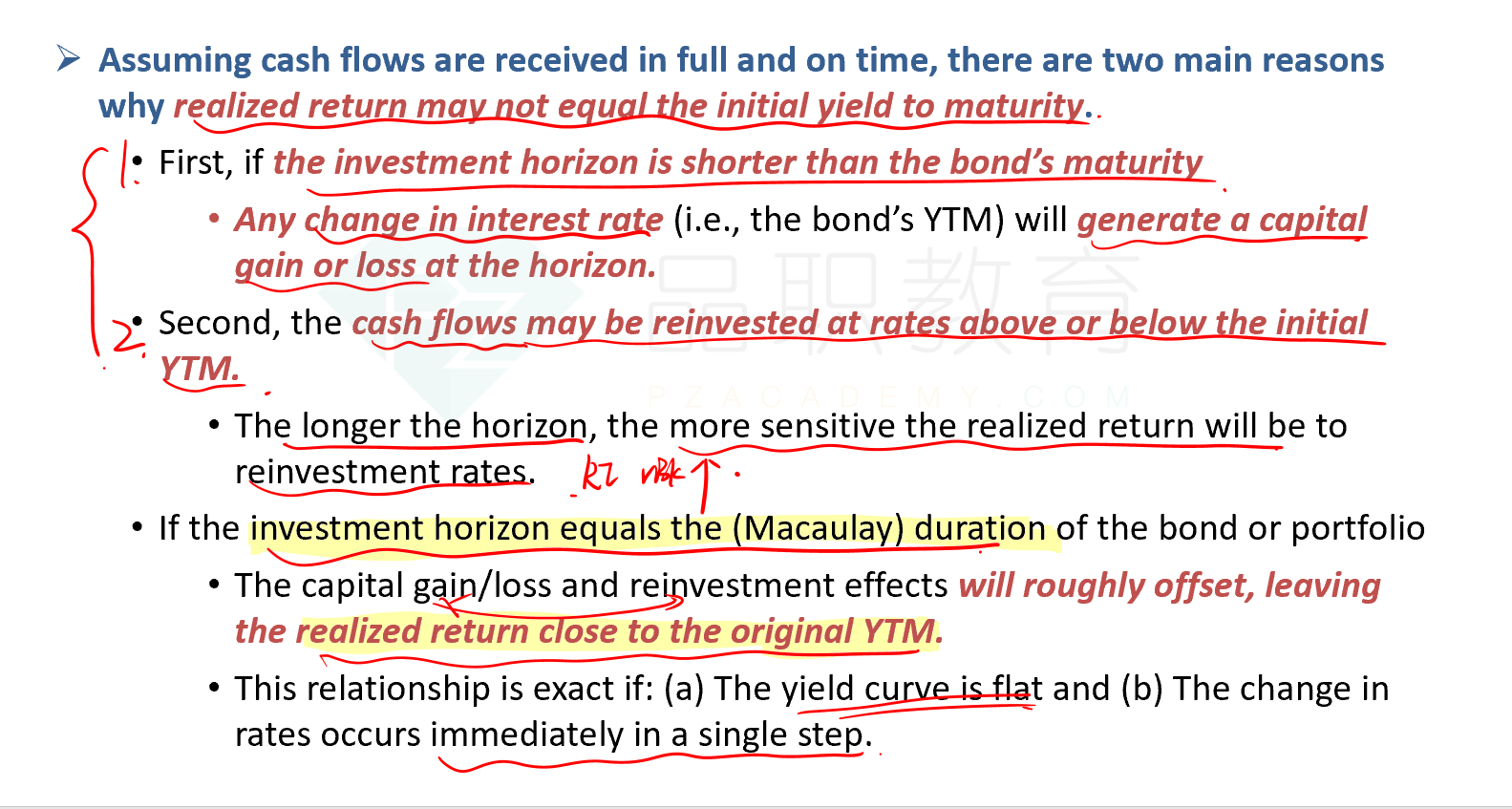

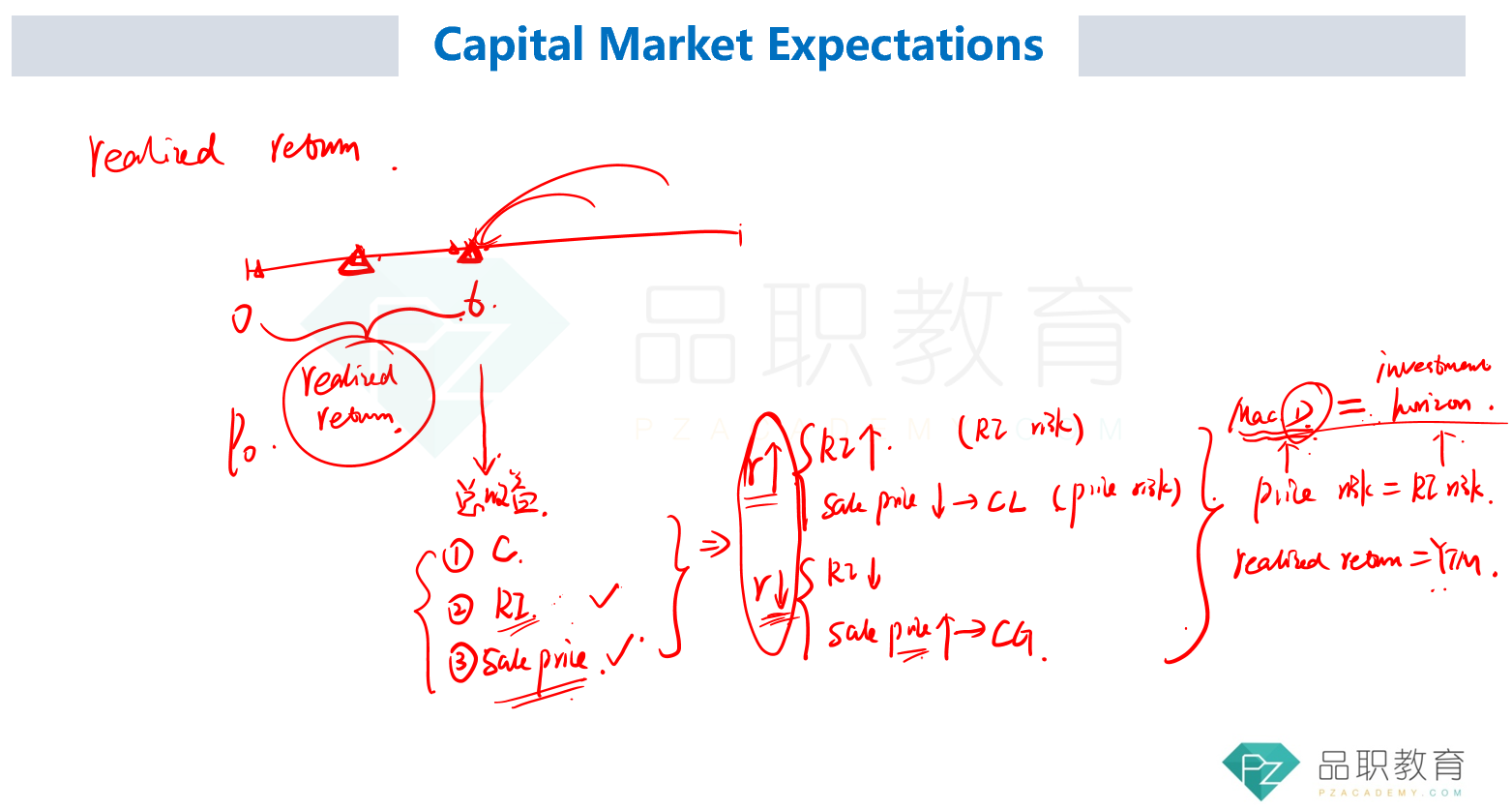

Over horizons shorter than the duration, the capital gain/loss impact will tend to dominate, so rising (declining) rates imply lower (higher) return. This also explains why Answer Choice (C) is incorrect. As for Answer Choice (A), over horizons longer than the duration, the reinvestment impact will tend to dominate, so rising (declining) rates imply higher (lower) return.

在短于久期的期限内,资本利得 / 损失的影响往往占主导地位,因此利率上升(下降)意味着回报降低(升高)。这也解释了为何选项(C)是错误的。至于选项(A),在长于久期的期限内,再投资影响往往占主导地位,因此利率上升(下降)意味着回报升高(降低)。

如题,请问可以详细说说吗?