NO.PZ2023010903000070

问题如下:

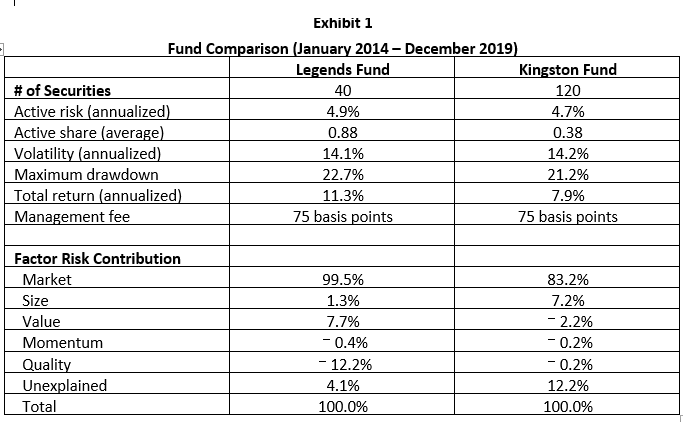

After answering a few additional questions, Swanson provides Rizzitano with a one-page document comparing the Legends Fund to the Kingston Fund. The information in this document is displayed in Exhibit 1. Swanson notes that the Kingston Fund is the Legends Fund's closest competitor and employs a very similar investment philosophy focused on quality. Swanson tells Rizzitano that the document demonstrates that the Legends Fund has a much more efficient portfolio structure than the Kingston Fund.

Identify two fund characteristics in Exhibit 1 that support Swanson's comment regarding the Legends Fund's relatively efficient portfolio structure.

解释:

Answer:

An efficient, well-constructed portfolio should have 1) risk exposures that align with investor expectations, and 2) low idiosyncratic(unexplained) risk relative to total risk.

The investment philosophies of both the Legends Fund and the Kingston Fund focus on the quality risk factor. However, the factor risk contributions provided in Exhibit 1 suggest that quality is a significant factor exposure for the Legends Fund at-12.2% but is insignificant for the Kingston Fund at -0.2%. This supports Swanson's statement.

In addition, the amount of idiosyncratic risk is much higher as a percentage of total risk for the Kingston Fund, at 12.2%, versus just 4.2% for the Legends Fund. This also supports Swanson's statement.

An efficient well structured portfolio must:

- align with manager’s expectations and have low unexplained risk to total risk. Portfolio A has high quality factor contribution and low unexplained risk to total risk.

- efficient risk. Portfolio A has high active share with low active risk.