NO.PZ202312250100000502

问题如下:

Based on the information in Exhibit 1, the cost of implementing a long straddle option hedge for the AUD capital call is closest to:

选项:

A.$117,250. B.$198,450. C.$207,200.解释:

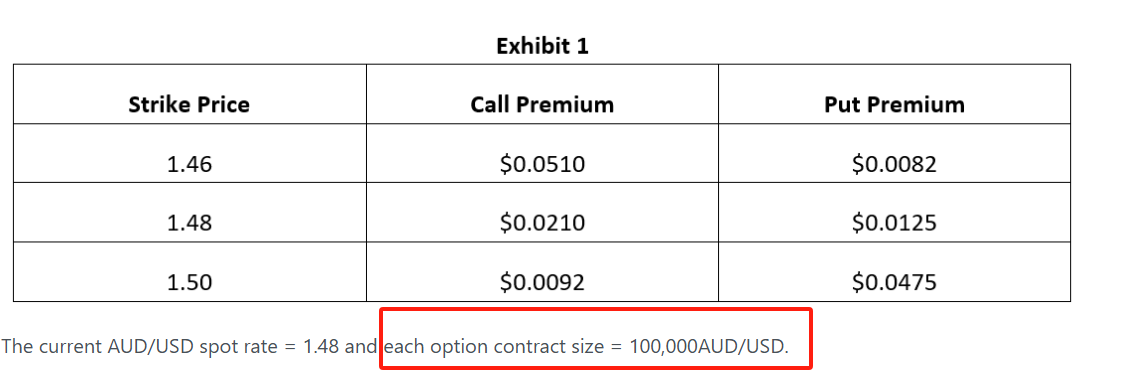

A long straddle option strategy is implemented by buying an at-the-money (ATM) call and buying an at-the-money (ATM) put for the AUD/USD currency pair.

Current AUD/USD spot rate is 1.48.

Cost of ATM call option+ Cost of ATM put option= $0.0210 + $0.0125 = $0.0335

Cost of straddle option strategy = $0.0335 × 100,000 = $3,350

Number of contracts required = Notional Amount/Contract Size= 3,500,000/100,000 = 35Total cost of the hedge = Cost per Contract × Number of Contracts= $3,350 × 35 = $117,250

contract size = 100,000AUD/USD.

请问这是什么意思,

为什么3.5 million AUD除以100000就是合约个数了?