NO.PZ202303270300006202

问题如下:

(2) Which of the following statements best characterizes how the active portfolio is positioned for yield curve changes relative to the index portfolio?

选项:

A.The active portfolio is positioned to benefit from a bear steepening of the yield curve versus the benchmark portfolio.

The active portfolio is positioned to benefit from a positive butterfly movement in the shape of the yield curve versus the index.

The active portfolio is positioned to benefit from yield curve flattening versus the index.

解释:

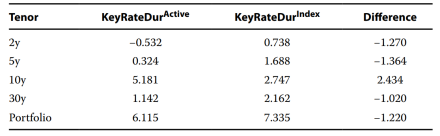

B is correct. A positive butterfly indicates a decrease in the butterfly spread due to an expected rise in short- and long-term yields-to-maturity combined with a lower medium-term yield-to-maturity. Since the active portfolio is short duration versus the index in the 2-year, 5-year, and 30-year maturities and long duration in the 10-year, it will generate excess return if the butterfly spread falls.

A至少不能说错吧?