NO.PZ2020033002000050

问题如下:

Ace Bank entered into a fixed-for-floating interest rate swap that starts today and ends in six years. If the duration of this position is proportional to the time to maturity and all changes in the yield curve are parallel shifts, and that the volatility of interest rates is proportional to the square root of time. When would the maximum potential exposure be reached?

选项:

A.Today B.In two years

C.In four years

D.In six years

六年后

解释:

考点:Credit exposure (信用风险敞口)

解析:

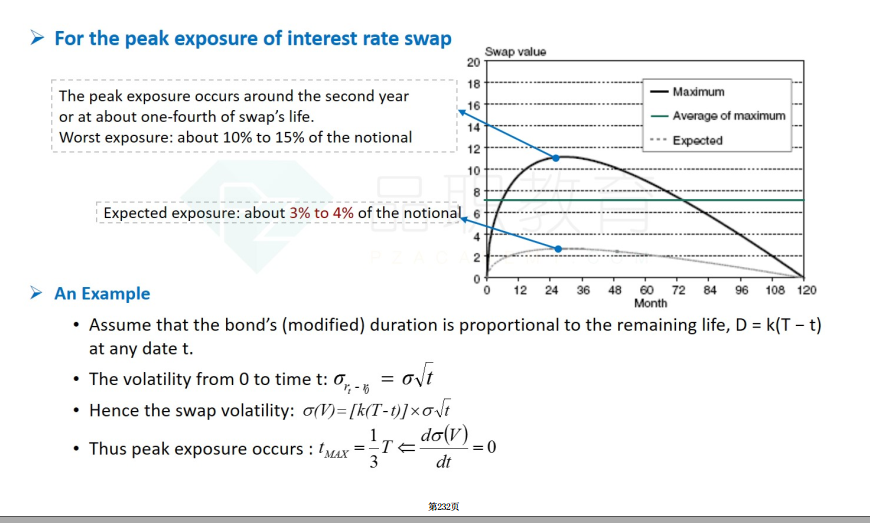

当总期限=6年时,根据最大潜在风险敞口的推导逻辑,极值点出现在T/3处,即在2年后达到最大风险敞口。

如题谢谢