NO.PZ2024050101000095

问题如下:

A bank enters into a swap agreement with a counterparty. The swap has no collateral requirements, and no netting agreements are present between the bank and the counterparty. The following data is available for the swap position:

• The counterparty expected exposure is 0.40% and approximately constant from month to month.

• The credit spread for a five year credit default swap on the counterparty is 500 bps.

• The counterparty’s probability of default within five years is 10%.

• The 5-year effective duration of the swap is 4.0.

Assuming no wrong-way risk on the position, which value is the closest approximation of the credit value adjustment expressed as a running spread?

选项:

A.2 bps

B.4 bps

C.5 bps

D.8 bps

解释:

英文解析:

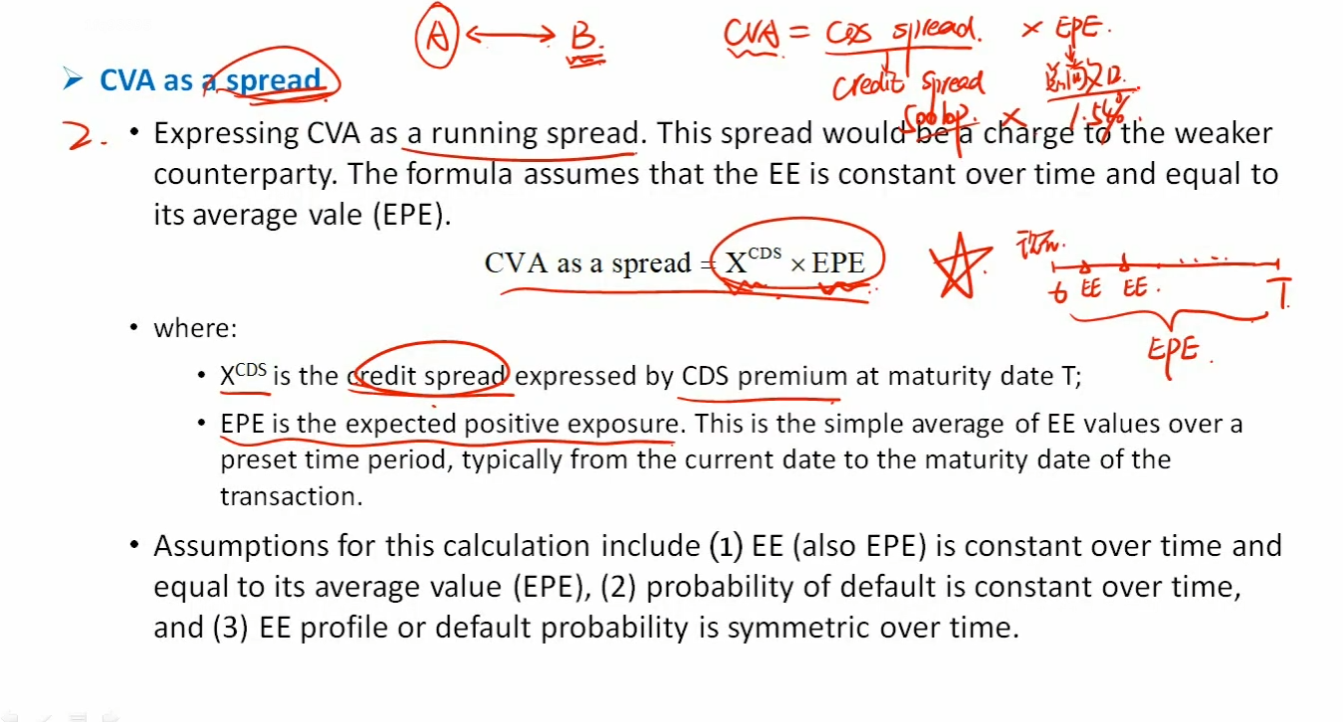

CVA= EE*spread=500bp*0.4%=2bp

中文解析:

信用价值调整运行利差

≈ 预期风险暴露(EE)× 信用违约互换(CDS)利差

= 0.05 * 0.004 = 0.0002(2个基点)

老师,根据讲义579页举的例子,CVA standalone要除以 (risky duration*notional amount), 答案只是计算了CVA standalone,为什么下面的就不算了呢?