NO.PZ2024050101000055

问题如下:

CDS spreads are that the PV of:

选项:

A.accrual payments is zero

B.expected payoff is less than the PV of expected payments during the life of the CDS

C.expected payoff is equal to the PV of expected payments during the life of the CDS

D.expected payoff is greater than the PV of expected payments during the life of the CDS

解释:

英文解析:

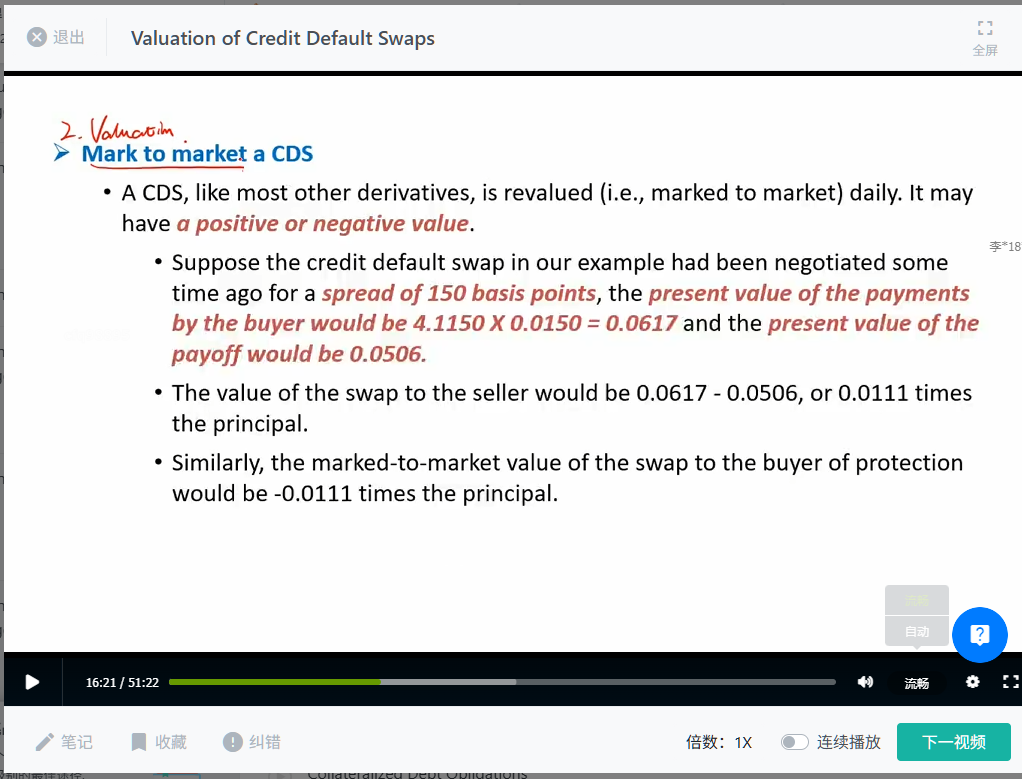

The CDS spread is set such that the PV of expected payoff is equal to the PV of expected payments during the life of the swap. The PV of expected payments includes the PV of expected periodic swap spread payments plus the PV of expected accrual payments.

中文解析:

信用违约互换(CDS)利差的设定应使预期收益的现值等于互换存续期内预期支付的现值。预期支付的现值包括预期定期互换利差支付的现值加上预期应计支付的现值。

RT