NO.PZ2019092801000012

问题如下:

Ingerðria Greslö

is an adviser with an investment management company and focuses on asset

allocation for the company’s high-net-worth investors. She prepares for a

meeting with Maarten Pua, a new client who recently inherited a $10 million

portfolio solely comprising public equities.

Greslö meets with

Pua and proposes that she create a multi-asset portfolio by selling a portion

of his equity holdings and investing the proceeds in another asset class.

Greslö advises Pua that his investment objective should be to select an asset

class that has a high potential to fulfill two functional roles: risk

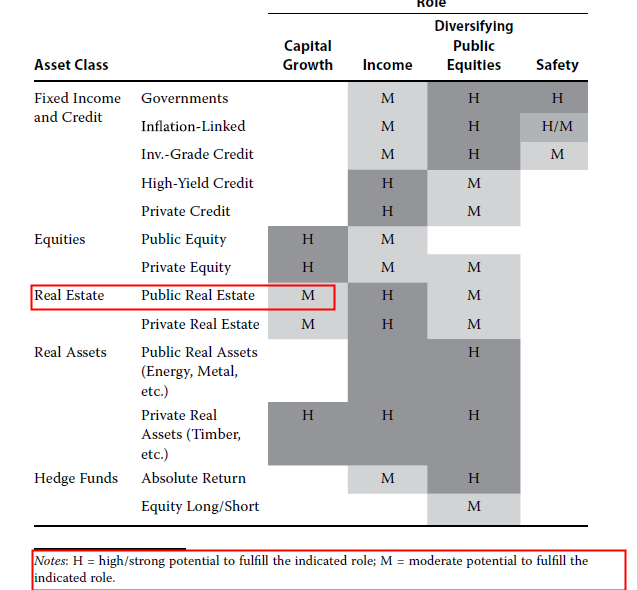

diversification and capital growth. Greslö suggests the following three asset

classes:

·

Public

real estate

·

Private

real assets (timber)

·

Equity

long/short hedge funds

Determine which asset class is most likely to meet Pua’s investment objective. Justify your response.

选项:

解释:

• 树木与公共股票的相关性较低,可以发挥分散风险的功能。

• 树木提供高长期回报,并能发挥资本增值的功能作用。

私人实物资产(树木)是最有可能实现 Pua 目标的资产类别。私人实物资产,例如树木,往往与股票的相关性较低,因此在 Pua 当前的全股票投资组合中,很有可能发挥分散风险的功能作用。此外,树木在实现投资组合中资本增长的功能作用方面具有很高的潜力,因为增长是由树木的潜在生物生长以及潜在土地价值的升值提供的。

与林地相比,作为资产类别的公共房地产可能提供较少的资本增长机会和较低的多元化收益。毕竟作为public,和二级市场的股票就有一些相似性,都是public,此外Public real estate升值潜力不大。此外,作为资产类别的Equity long/short hedge funds将在 Pua 的全股票投资组合中提供适度的风险分散,但不具有显着的资本增长潜力。因为Equity long/short hedge funds的β很小,虽然volatility小了,收益也下降了。

Private real assets (Timber) is most likely to meet Pua’s investment objective.

It has both high diversification benefit and capital growth potential.

The pubic real estate has moderate diversification benefit and capital growth potential.

The equity long/short hedge fund only has moderate diversification benefit.