NO.PZ2022071105000008

问题如下:

A risk analyst at an investment bank is evaluating the bank’s risk measurement process. The bank currently

uses VaR as its primary risk measure, but the analyst believes ES may be a better measure to use during periods

of market turmoil. When comparing VaR and ES, which of the following statements is correct?

选项:

A.

For the same confidence level, ES is always greater than VaR.

B.

If a VaR backtest at a specified confidence level is accepted, then the corresponding ES will always be

accepted.

C.

While VaR ensures that the estimate of portfolio risk is less than or equal to the sum of the risks of that

portfolio’s positions, ES does not.

D.

While ES is more complicated to calculate than VaR, it is easier to backtest than VaR

解释:

中文解析:

A是正确的。对于给定的的置信度,ES总是大于或等于VaR,因为ES计算的是超过VaR阈值的更极端的尾部损失的均值。

B是不正确的。VaR回测接受原假设并不能保证ES的正确性。

C是不正确的。VaR不满足次可加性,ES满足次可加性。

D不正确。ES回测更为复杂,因为VaR回测只需要关注损失超过VaR的次数,而ES回溯则需要超出ES的损失的大小。

A is correct. Expected shortfall is always greater than or equal to VaR for a given

confidence level α, since α measures the minimum loss in case the worst α probability

event happens and ES accounts for the severity of expected losses beyond VaR.

B is incorrect. The VaR backtest acceptance does not guarantee the correctness of the ES

calculation.

C is incorrect. VaR is not subadditive. ES is subadditive.

D is incorrect. Backtesting ES is more complicated because while VaR backtesting deals

with the number of VaR violations, ES backtesting also deals with the magnitude of such

violations.

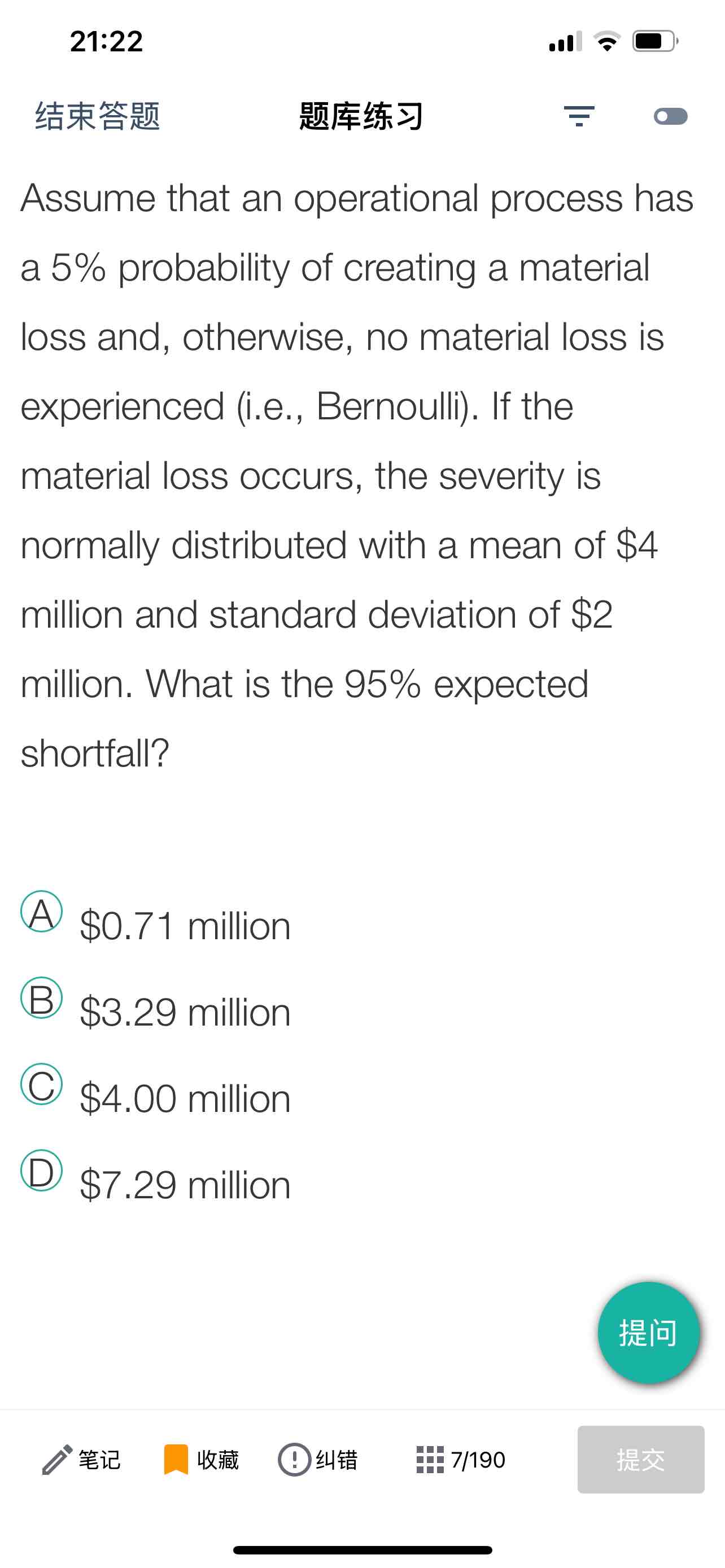

老师,A太绝对了吧,比如离散的分布,要么5%有损失,有就是4,要么95%没损失,那么VaR不就等于ES?类似这道题