NO.PZ201809170400000404

问题如下:

Which activist investing tactic is Asgard least likely to use?

选项:

A.Engaging with management by writing letters to management, calling for and explaining suggested changes, and participating in management discussions with analysts or meeting the management team privately.

B.Launching legal proceedings against existing management for breach of fiduciary duties.

C.Proposing restructuring of the balance sheet to better utilize capital and potentially initiate share buybacks or increase dividends.

解释:

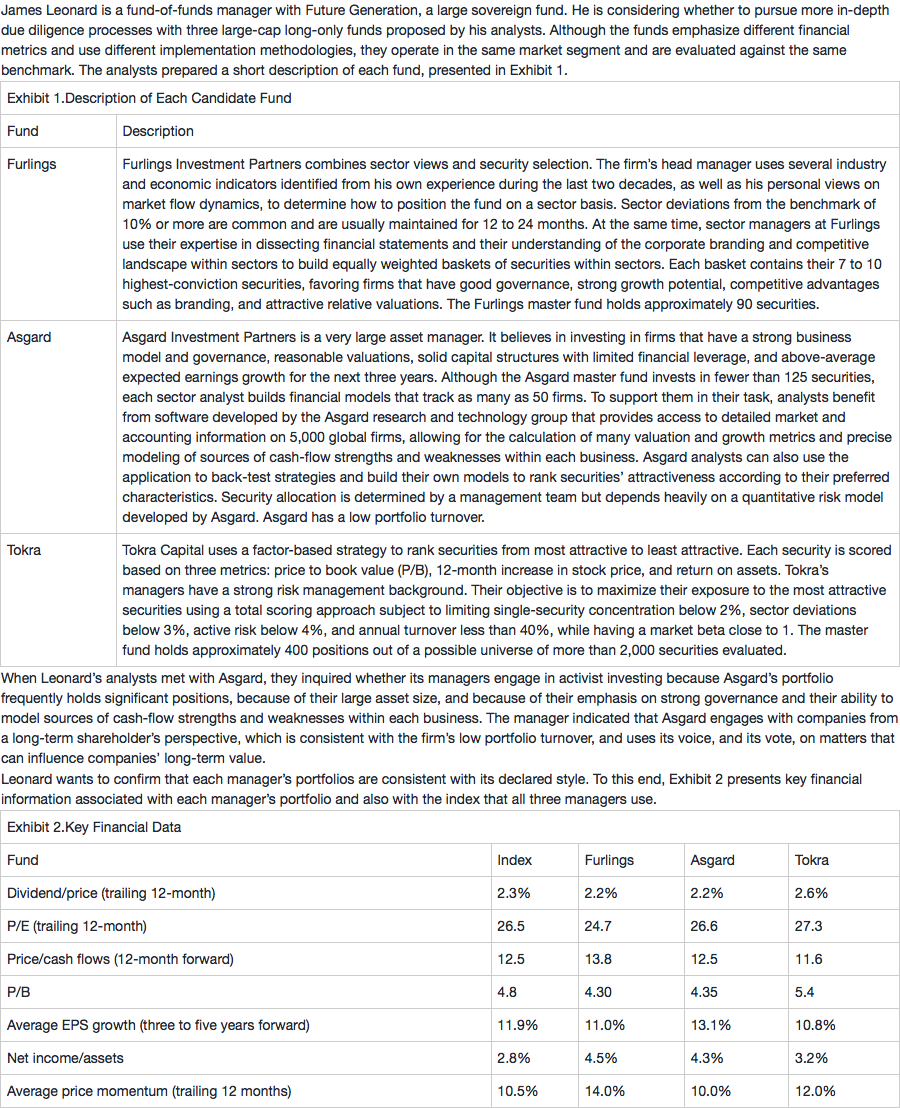

B is the correct answer. Asgard invests in firms that have strong business models and good governance. Also, it approaches investing as a long-term investor looking to use its voice to improve the company’s asset management. Asgard is unlikely to use an aggressive posturing or to invest or stay invested in companies with weak governance or where managers may be in breach of fiduciary duties.

A is an incorrect answer. Engaging in positive conversations with management of companies with which Asgard has invested reflects a use of its voice to improve these companies’ long-term value.

C is an incorrect answer. Because Asgard is strong at modeling sources of cash flows and is known for investing in companies with a strong capital structure, it would be consistent for Asgard to propose ways to optimize the capital structure and shareholders’ compensation.

文中有句话这样描述

“” Asgard engages with companies from a long-term shareholder’s perspective, which is consistent with the firm’s low portfolio turnover, and uses its voice, and its vote, on matters that can influence companies’ long-term value.“”

股票回购和分红是和公司的长期发展有关的吗?感觉影响短期多呀,因为这个选了C,可以从这个角度考虑吗?