NO.PZ201809170400000403

问题如下:

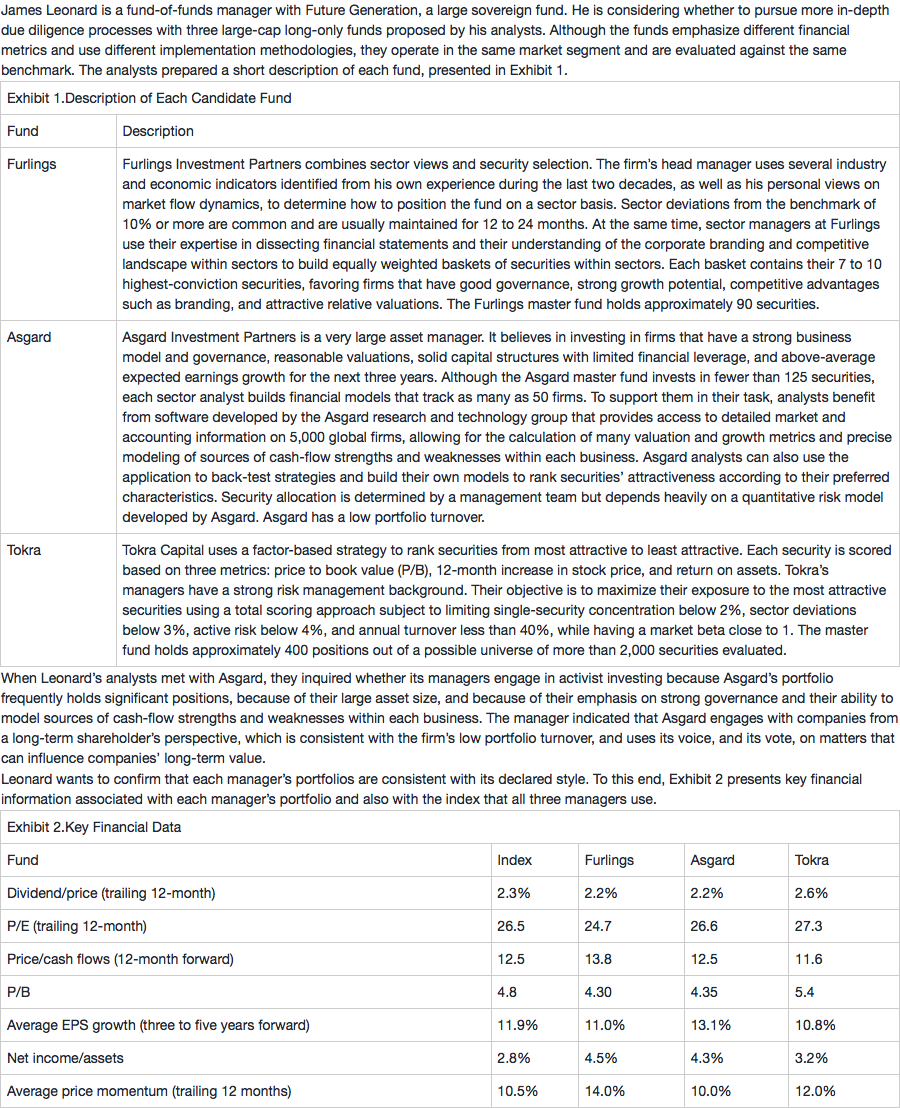

Which manager is most likely to get caught in a value trap?

选项:

A.Furlings

B.Asgard

C.Tokra

解释:

C is the correct answer. A value trap occurs when a stock that appears to have an attractive valuation because of a low P/E and/or P/B multiple (or other relevant value proxies) appears cheap only because of its worsening growth prospects. Although a pitfall such as value trap is more common in fundamental investing, a quantitative process that relies on historical information and does not integrate future expectations about cash flows or profitability may be unable to detect a value trap.

A is an incorrect answer. Although Furlings is a top-down manager, its sector portfolios are built through investing in a small number of high-conviction securities after its analysts have dissected the financial statements and analyzed the competitive landscape and growth prospects. Managers at Furlings are more likely than managers at Tokra to be aware of the significant deteriorating prospects of a security they are considering for investment.

B is an incorrect answer. One of Asgard’s investment criteria is identifying firms that have good potential cash flow growth over the next three years. The firm has access to database and support tools, allowing its analysts to evaluate many potential growth metrics. Managers at Asgard are more likely than managers at Tokra to be aware of the significant deteriorating prospects of a security they are considering for investment.

而且furling 是fundamental的方法,更应该出现value trap呀,为什么会选C