NO.PZ202303150300000404

问题如下:

Using Yee’s alternative valuation assumptions and the FCFE valuation approach, the year-end 2012 value per share of McLaughlin’s common stock is closest to:选项:

A.$24.17. B.$18.00. C.$22.80.解释:

SolutionC is correct. First, it is necessary to estimate FCFE2013.

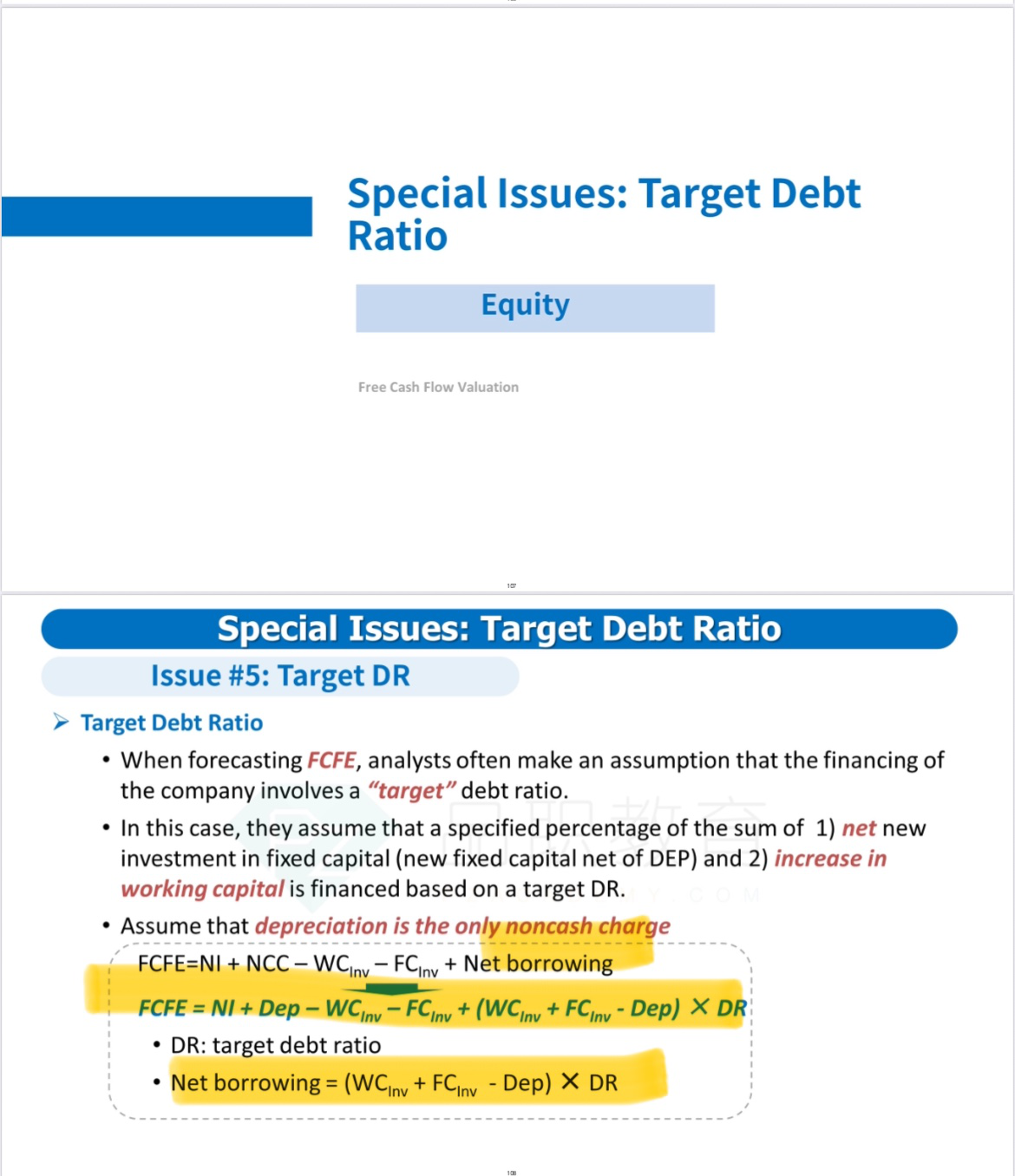

FCFE = Net income – (1 – DR) × (FCInv – Depreciation) – (1 – DR) × (WCInv)

where

DR = debt ratio, which is 40%

FCInv = investment in fixed capital, which is 30% of EPS

WCInv = investment in working capital, which is 10% of EPS

On a per-share basis:

FCFE1 (2013) = 1.80 – (1 – 0.40) × (0.30 ×1.80) – (1 – 0.40) × (0.10 ×1.80)

= 1.80 – 0.324 – 0.108

= 1.368.

FCFE will grow at the same rate as net income, 6% annually.

The value per share is $22.80.

A is incorrect. It uses FCFE1 × (1 + g) = 1.368 × (1.06)/(0.12 – 0.06) = 24.17.

B is incorrect. It uses FCFF: (1.80 – 0.54 – 0.18 )/(0.12 – 0.06) = 18.00

请问这个公式需要记忆吗?是否是知识点?