NO.PZ2023120801000066

问题如下:

An investor purchases an eight-year, 6.4% annual coupon eurobond priced at par and sells it after six years. Assuming interest rates rise by 100 bps immediately after purchase, the investor’s rate of return at the end of six years is:

选项:

A.lower than 6.4%

equal to 6.4%

higher than 6.4%

解释:

Correct Answer: A

The future value of reinvested coupon interest is:

N=6, PV=0, PMT=6.4, I/Y=7.4, CPT→FV=46.245

The sale price of the bond at the end of six years is:

N=2, FV=100, PMT=6.4, I/Y=7.4, CPT→PV=98.202

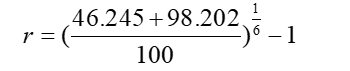

which results in a six-year horizon yield of 6.32%, which is lower than 6.40%:

the investor’s rate of return at the end of six years is 这个问题能解释一下吗

=6.32%

=6.32%