NO.PZ2025022501000067

问题如下:

The introduction of environmental regulation has significant negative effects on a company's competitors but no impact on the company. The most appropriate way to reflect this in a discounted cash flow analysis of the company is to:选项:

A.increase the discount rate.

B.increase projected cash flows.

C.decrease the terminal growth rate.

解释:

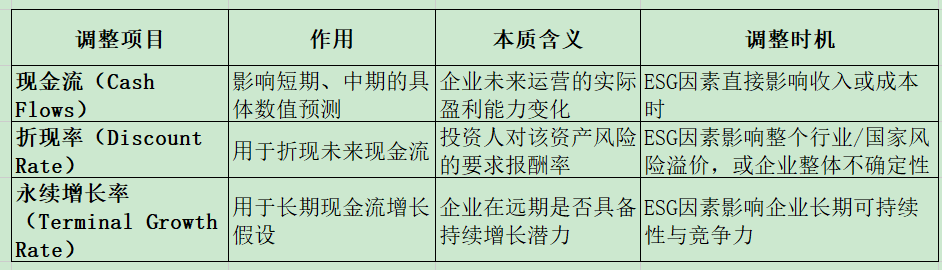

B is correct because adjustments to the discount rate or terminal growth rate can be based on individual company factors or on a country or sector basis. For example, all coal producers and coal-powered utilities might be judged to have higher climate-related risk and thus higher discount rates. Similarly, companies with strong ESG practices could be seen as less risky, allowing for a lower discount rate. A higher (lower) discount rate leads to, all else equal, a lower (higher) estimate of intrinsic value. Therefore, to capture the opportunity from weaker competitors, the analyst would likely decrease, not increase, the discount rate to reflect the company's lower risk from an improved market position or power.想问在某个情境下,如何判断应该调整现金流、折现率以及永续增长率中的哪个值?三者间是否也存在不能同时调整的情况?最好能分别举例说明