NO.PZ2025022501000053

问题如下:

Which of the following would be considered the most effective form of investor engagement?选项:

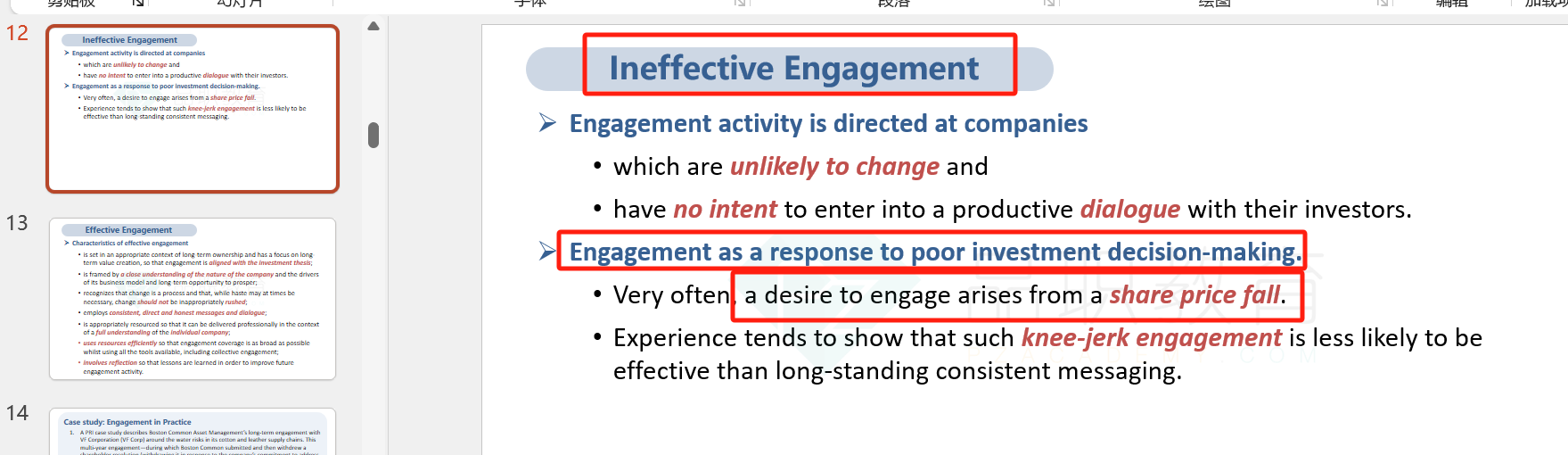

A.Initiating a dialogue with the investee company following a share price fall

B.Highlighting concerns about long-term key issues to non-executive directors of the investee company

C.Requesting information on specific governance, social or environmental issues from the investee company

解释:

A is incorrect because very often, adesire to engage arises from a share price fall. Active fund managers may thenbecome concerned about issues that may have been apparent for a time but whichmay have been ignored as the performance was positive. Experience tends to showthat such knee-jerk engagement is less likely to be effective thanlong-standing consistent messaging (where intensity may increase at moments ofdifficulty, but do not just begin at those moments).

B is correct because engagementdialogues are conversations between investors and any level of the investeeentity (including non-executive directors) featuring a two-way sharing ofperspectives, such that the investors express their position on key issues, andin particular, highlight any concerns that they may have. In addition,engagement is set in a context of long-term ownership and focus on long-termvalue preservation and creation, so that engagement is aligned with investmentthesis.

请解释一下A选项及其解析,为什么不选它