NO.PZ202407070100000103

问题如下:

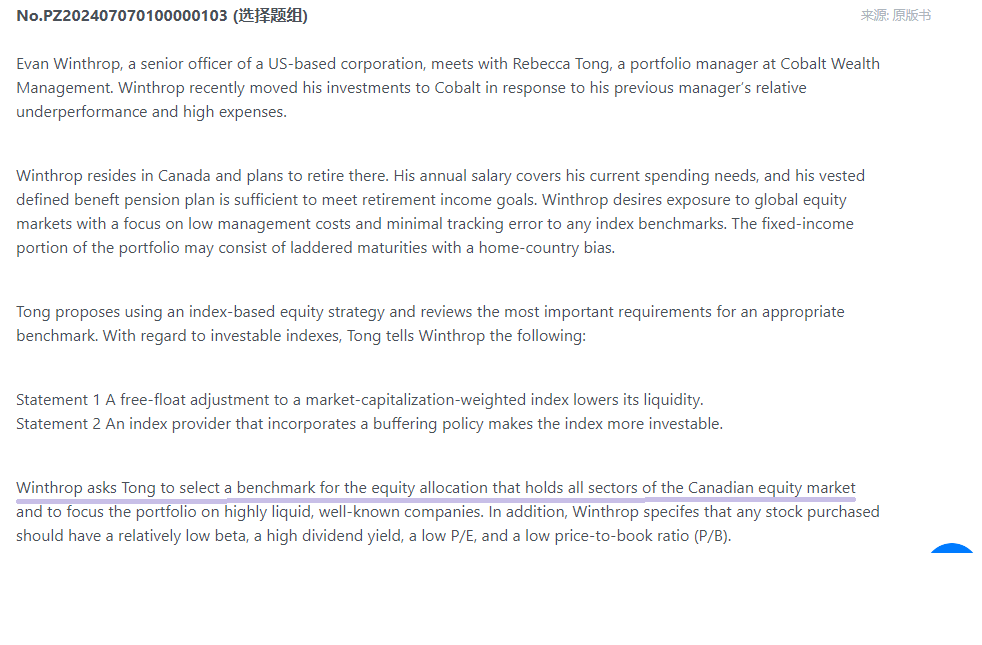

What is a problem with Winthrop’s benchmark preference?

选项:

A.The geographic limitation to Canadian equities

The exclusion of fixed-income securities given Winthrop’s signifcant exposure

The inclusion of all sectors

解释:

Winthrop desires exposure to global equity markets, so the equity benchmark should be global as well—for example, the MSCI All Country World Index.

B is incorrect because Winthrop was stating a preference for the benchmark for his equity allocation. Including fixed income would be inappropriate.

C is incorrect because including all sectors is appropriate because his investment strategy includes all sectors.

The fixed-income portion of the portfolio may consist of laddered maturities with a home-country bias.

还有选项C ,all sector题中哪里有提到?全球股票市场指数就是包含所有sector吗?