NO.PZ202212300200003001

问题如下:

Given the information in Exhibit 1, the minimum cost

of implementing Strategy 1 is closest to:

选项:

A.

$12.49

B.

$12.75

C.

$12.86

解释:

Correct Answer: A

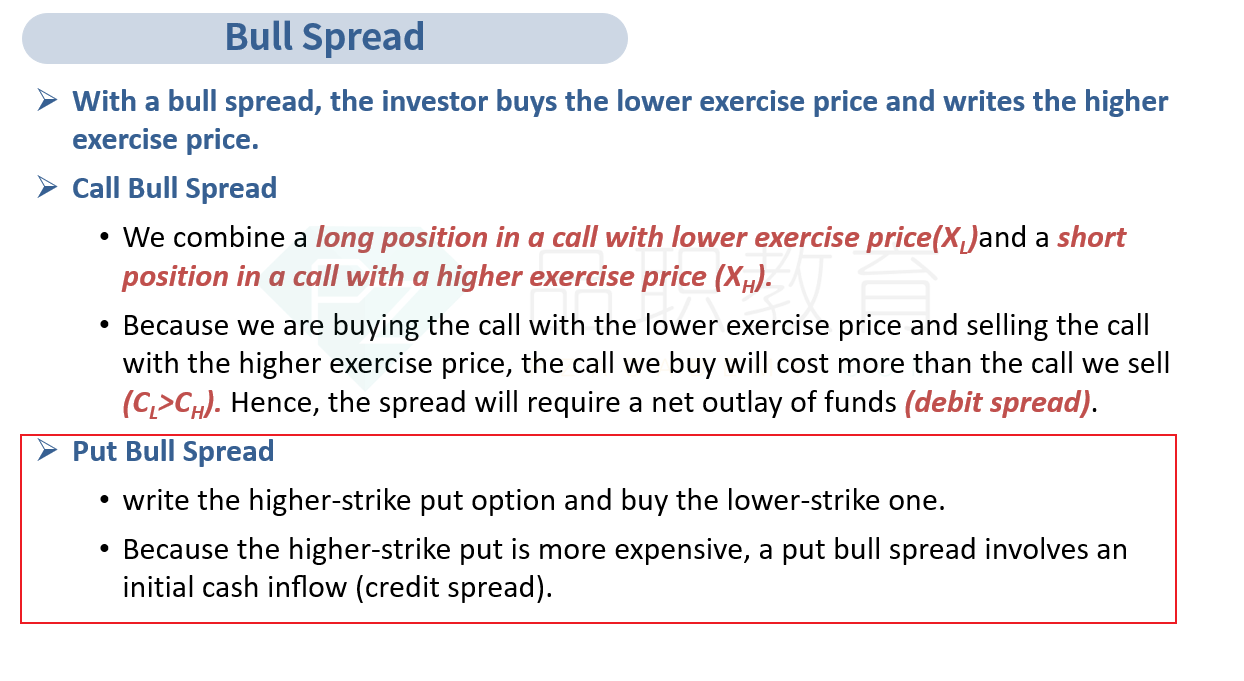

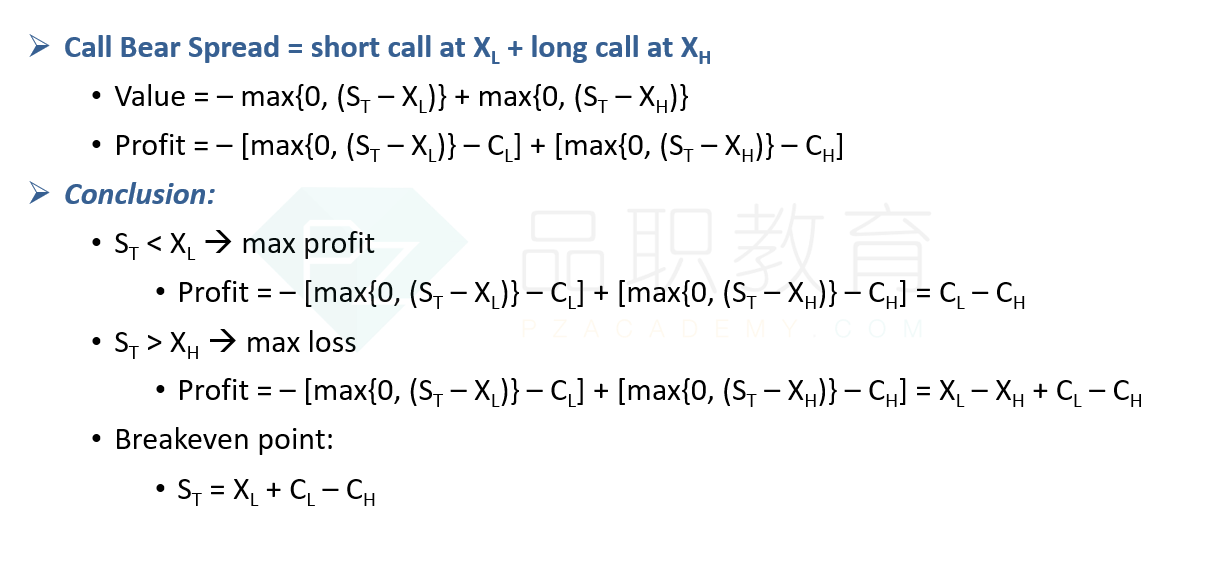

A bull call spread

is constructed by buying a lower exercise call and writing a higher exercise

call. A bull spread becomes more valuable when the price of the underlying asset

rises. The minimum cost implementation would typically use options with strike prices

close to the current market price.

Buy $25 strike

call and sell $35 strike call

Net premium for a

bull call spread Vo = cL – cH = $10.30 – $1.45 = $8.85

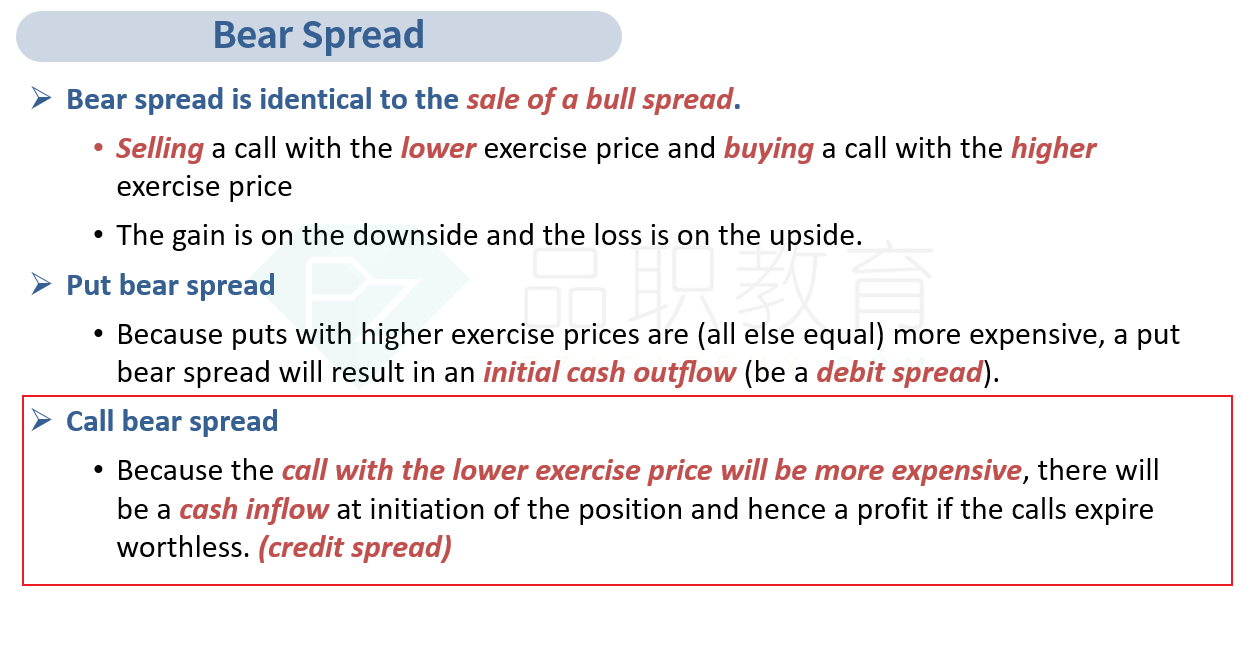

A bear put spread

is constructed by buying a higher exercise put and writing a lower exercise

put. A bear spread becomes more valuable when the price of the underlying asset

declines. The minimum cost implementation would typically use options with

strike prices close to the current market price.

Buy $35 strike put

and sell $25 strike put

Net premium for a

bull call spread Vo = pH – pL = $5.20 – $1.56 = $3.64

Total cost = $8.85

+ $3.64 = $12.49

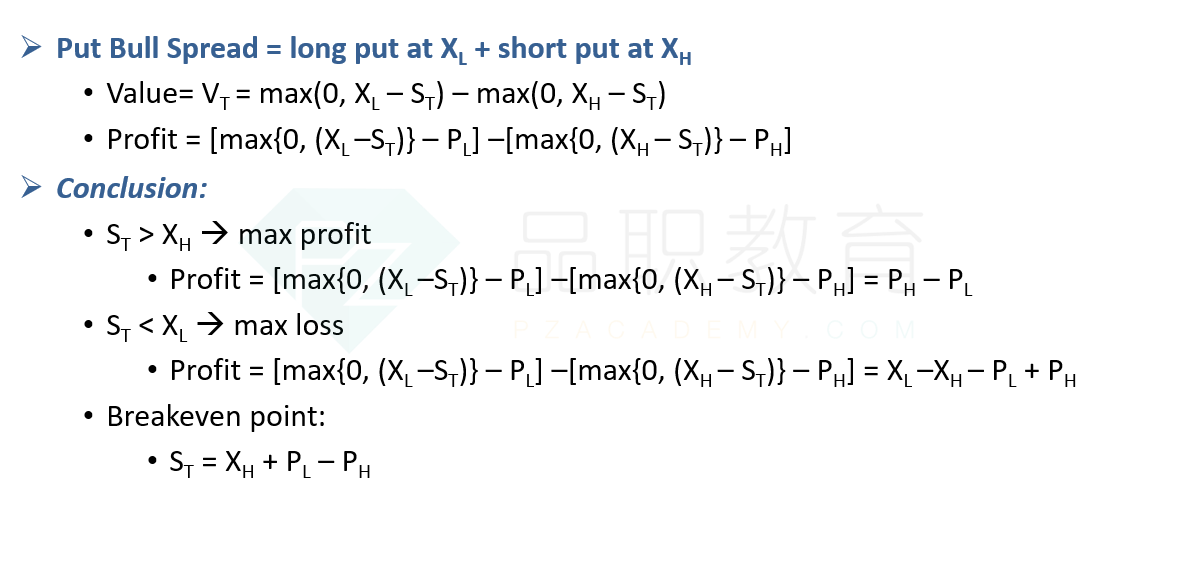

存在bear call和bull put吗