NO.PZ2023081403000142

问题如下:

Q. Which of the following choices best describes reasonable conclusions an analyst might make about the company’s solvency?The following data appear in the five-year summary of a major international company. A business combination with another major manufacturer took place in FY13.

Exhibit 1:

Five-Year Summary of a Major International Company

选项:

A.Comparing FY14 with FY10, the company’s solvency improved, as indicated by the growth in its profits to GBP 645 million. B.Comparing FY14 with FY10, the company’s solvency deteriorated, as indicated by a decrease in interest coverage from 10.6 to 8.4. C.Comparing FY14 with FY10, the company’s solvency improved, as indicated by an increase in its debt-to-assets ratio from 0.14 to 0.27.解释:

B is correct. Comparing FY14 with FY10, the company’s solvency deteriorated, as indicated by a decrease in interest coverage from 10.6 (= 844/80) in FY10 to 8.4 (= 1,579/188) in FY14. The debt-to-asset ratio increased from 0.14 (= 602/4,384) in FY10 to 0.27 (= 3,707/13,799) in FY14. This is also indicative of deteriorating solvency. In isolation, the amount of profits does not provide enough information to assess solvency.

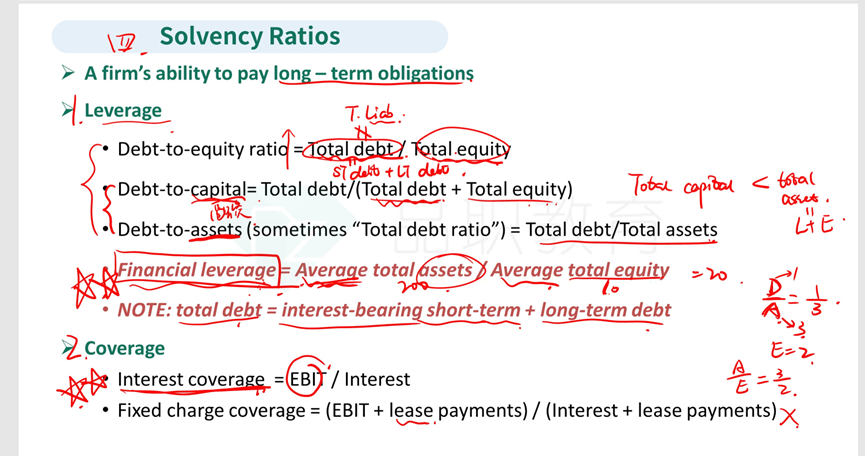

为什么不用total debt /total assets, ppt用的total debt.

因为衡量的长期偿债能力,所以debt只选了长期的,并不是这个公式必须用long-term debt?