NO.PZ2024021801000008

问题如下:

Which of the following ESG screening methodologies is criticized for not considering stewardship and engagement activities?

选项:

A.Relative basis screening only

B.Absolute basis screening only

C.Both relative and absolute basis screening

解释:

A. Incorrect because the criticism is also leveled at the absolute basis screening approach. Despite the clear organizational benefits of ESG screening, whether on an absolute or relative basis, its approach does carry several challenges. One common criticism is its reductive approach. In other words, its quantitative measure does not consider softer forms of ESG, such as stewardship and engagement activities.

B. Incorrect because the criticism is also leveled at the relative basis screening approach. Despite the clear organizational benefits of ESG screening, whether on an absolute or relative basis, its approach does carry several challenges. One common criticism is its reductive approach. In other words, its quantitative measure does not consider softer forms of ESG, such as stewardship and engagement activities.

C. Correct because despite the clear organizational benefits of ESG screening, whether on an absolute or relative basis, its approach does carry several challenges. One common criticism is its reductive approach. In other words, its quantitative measure does not consider softer forms of ESG, such as stewardship and engagement activities. In fact, an investor whose portfolio focuses on long-term stewardship opportunities in poorly rated ESG companies in order to improve performance will likely suffer from the poor optics of these companies at the portfolio level.

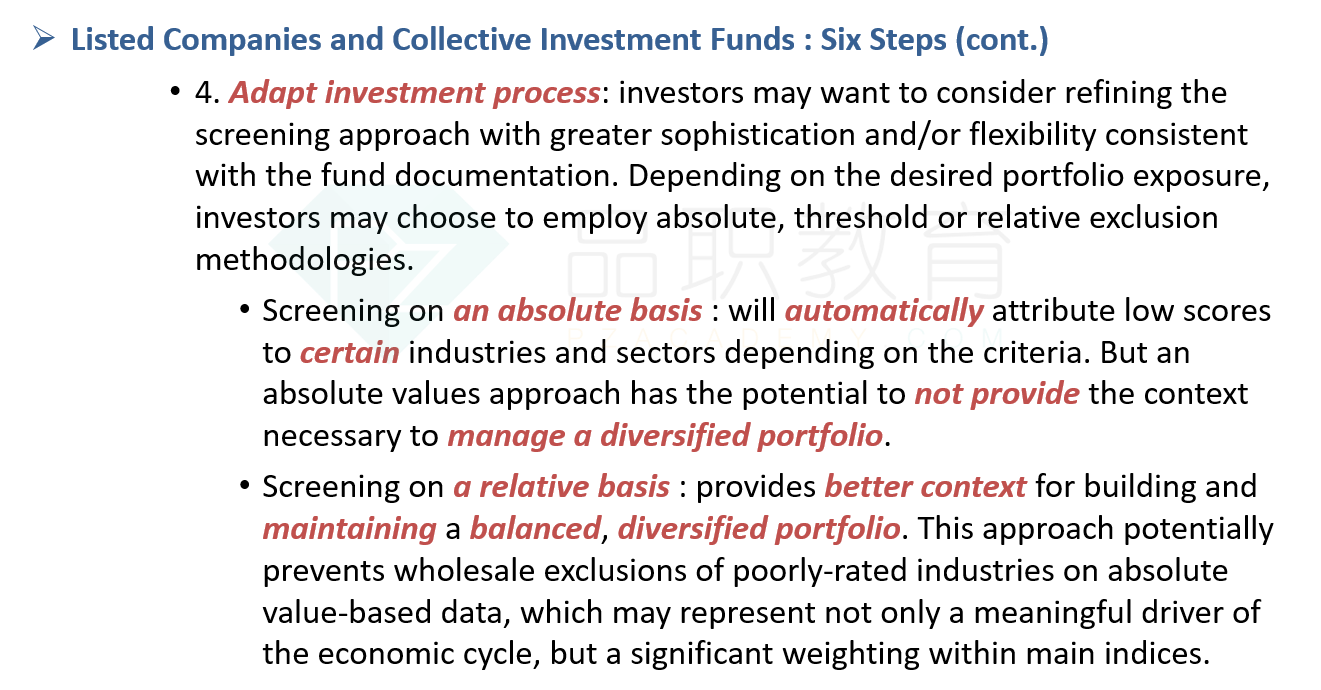

Absolute和relative basic的区别是什么