NO.PZ2023102101000072

问题如下:

After reviewing the results of a successful mid-year

stress test performed by EveRate Bank (ERB), a risk analyst at a national

financial supervisory authority prepares a summary report showing how the

quality of the bank’s overall risk management compares with that of its

industry competitors. ERB determines its capital adequacy and planning based on

an internal assessment of risks, asset-Liability efficiency, capital return

analyses, and regulatory capital requirements. In preparing the report, the analyst

uses five competitors as a proxy for the industry benchmark. The analyst

assumes that individual trading positions for the bank and its competitors are

of equal size. ERB reports assets and liabilities at market value. Relevant

information about the bank and its peers under normal market conditions are

shown below:

The analyst assumes that daily portfolio returns for ERB and its competitors are normally distributed with a common mean of zero and are serially independent to each other. Which of the following conclusions is most appropriate to make about how ERB’s performance compares to the industry benchmark?

选项:

A.

ERB’s market risk of its trading book is higher

B.

ERB’s liquidity trading risk is higher

C.

ERB’s credit quality is higher

D.

ERB’s Basel III Tier 1 leverage ratio is higher

解释:

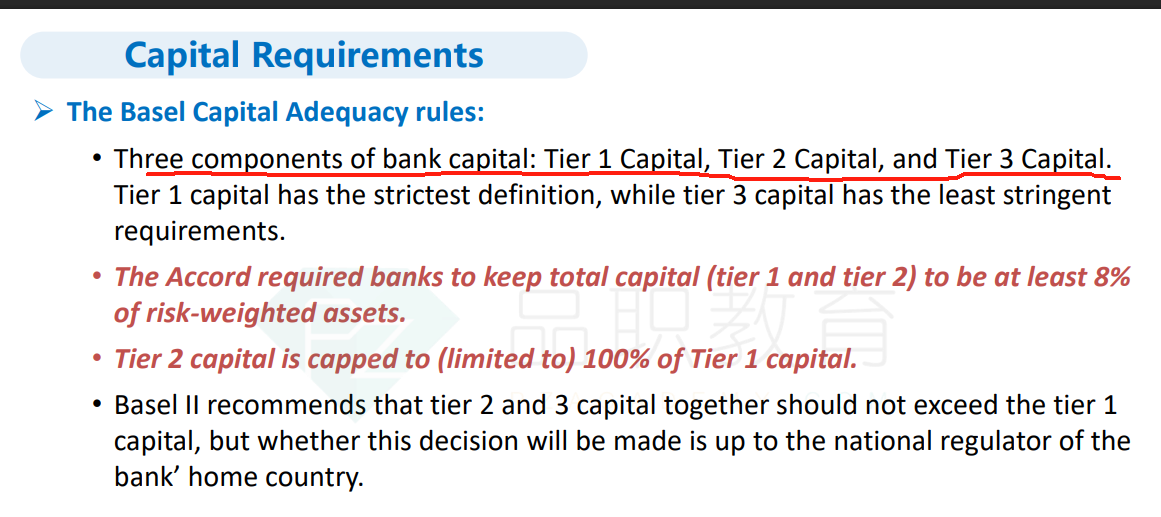

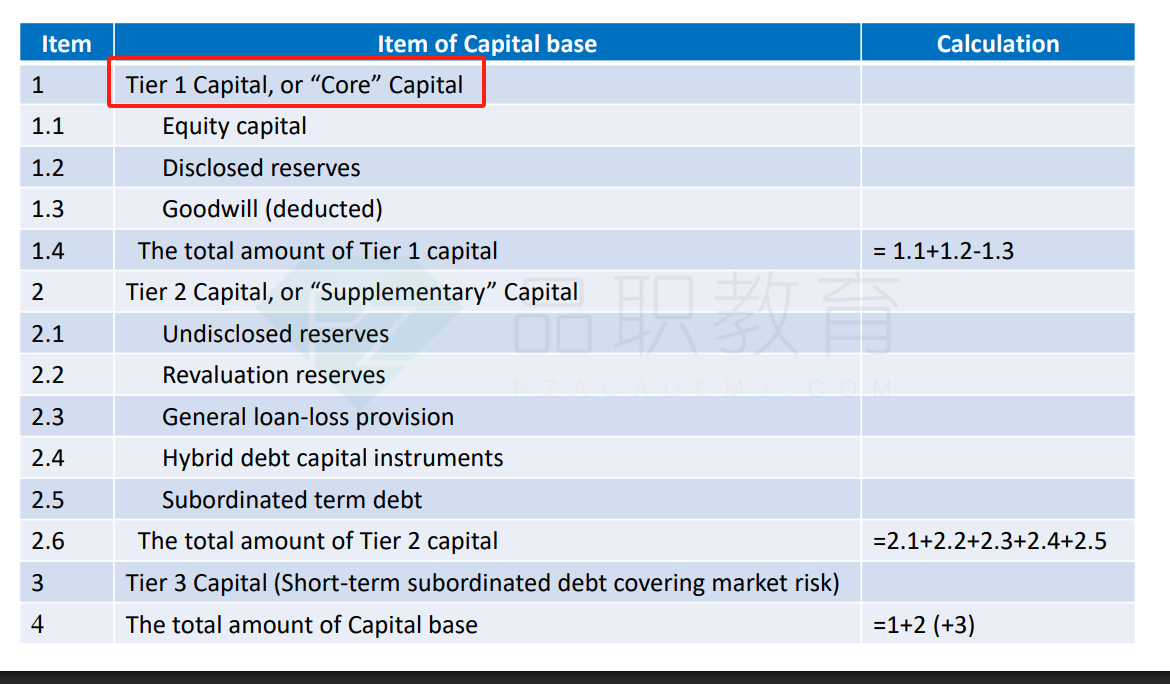

D is correct. The Basel III Tier 1 leverage ratio = (Core Tier 1

capital)/(Leverage exposure) = 2/31 = 6.45%, which is higher than the average

6% for the industry peers. A higher leverage ratio for capital requirement is

better.

A is incorrect. Under the distributional assumption,

VaR at a 99% confidence level is approximately equal to ES at a 97.5%

confidence level. ES is the average observation of losses that exceed the VaR.

Therefore, if Bank ERB’s 99% ES is equal to the industry benchmark’s 99% VaR,

it can be argued that Bank ERB’s market risk is lower, not higher, than the

benchmark since all of the benchmark observations above the VaR will need to be

higher than USD 7 million. Also, the portfolio return distributions of ERB and

the peer firms may be different.

B is incorrect. There is not enough information to determine the levels of

liquidity trading risk (or, e.g., Liquidity adjusted VaR) for both the bank and

the benchmark. ERB’s liquidity trading risk is not necessarily higher just

because it has a smaller number of trading positions. A higher number of

trading positions may induce a diversification effect, which lowers market

risk. However, diversification has no effect on liquidity trading risk.

C is incorrect. Assuming a constant hazard rate, and using the hazard rate

process, the average default probability for the industry benchmark = PD = 1 –

exp(-l*t) = 1 – exp(-0.05*1) = 4.88%, where t = 1 year.

Since ERB’s PD (= 5%) is higher, its credit quality is lower than that of the

benchmark.

老师好,关于D选项,Everate 只给了核心一级资本啊,但是leverage ratio 分子不应该是总的一级资本吗?