NO.PZ2019012201000062

问题如下:

Fund 1 focuses on skillfully timing exposures to factors, both rewarded and unrewarded, and to other asset classes. The fund’s managers use timing skills to opportunistically shift their portfolio to capture returns from factors such as country, asset class, and sector. Fund 1 prefers to make large trades.The main building block of portfolio construction on which Fund 1 focuses is most likely:

选项:

A.alpha skills

position sizing

rewarded factor weightings

解释:

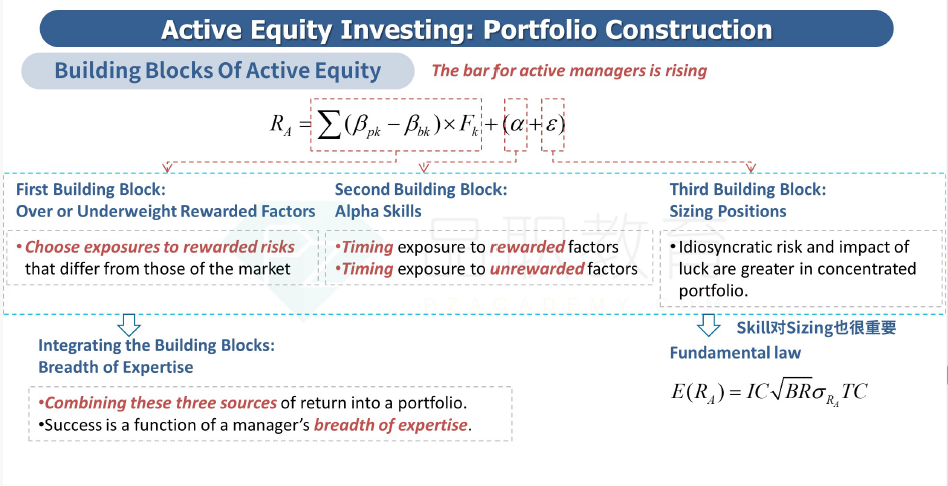

The three main

building blocks of portfolio construction are alpha skills, position sizing,

and rewarded factor weightings. Fund 1 generates active returns by skillfully

timing exposures to factors, both rewarded and unrewarded, and to other asset

classes, which constitute a manager’s alpha skills.

B选项不属于三种超额收益来源中的吧 这个是不是浑水摸鱼的