QUESTION SET 4

TOPIC: PORTFOLIO MANAGEMENT – INSTITUTIONAL

TOTAL POINT VALUE OF THIS QUESTION SET IS 12 POINTS

Eve Harlow, the owner of restaurant chain Burger Shack, meets with financial advisor Neil Almond to review the company’s defined benefit pension plan. Currently, the plan’s assets equal the plan’s liabilities. The plan’s objective is to maintain a 100% funded ratio using publicly traded investment vehicles. The plan’s portfolio has not been reviewed since the plan was established seven years ago.

Almond gathers statistics on company characteristics and determines that the workforce is young and there are no major upcoming liquidity needs. Almond concludes that the Burger Shack pension plan has a high risk tolerance. The plan’s actuaries determine that a 7% annual return for plan assets will keep pace with the liabilities.

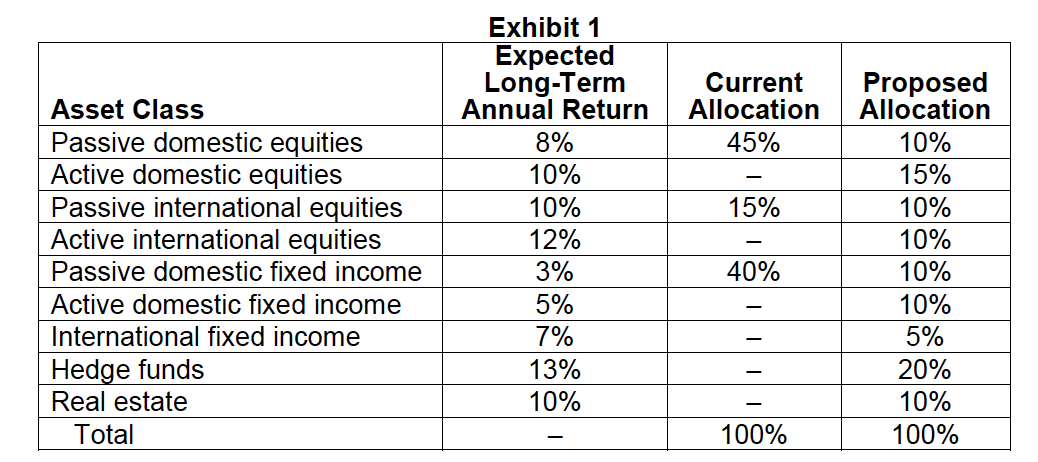

Almond begins drafting an IPS to share with Harlow. In addition, he obtains the most recent statements and begins reviewing the current asset allocation. He creates a new proposed asset allocation, as shown in Exhibit 1.

B. Identify both the current investment approach and the proposed investment approach for the Burger Shack pension plan.

(Canada model, Endowment model, Liability-Driven Investment model, Norway model)

List one drawback of each approach identified.

请问 proposed investment approach 为什么不是Canada model?为什么不是Liability-Driven Investment model?要从什么角度考虑?谢谢!