NO.PZ2023102101000045

问题如下:

The CFO at a bank is preparing a report to the board of directors on

its compliance with Basel requirements. The bank’s average capital and total

exposure for the most recent quarter is as follows:

Using the Basel III framework, which of the

following is the best estimate of the bank’s current leverage ratio? (Practice

Exam)

选项:

A.

2.94%

B.

3.70%

C.

4.68%

D.

5.08%

解释:

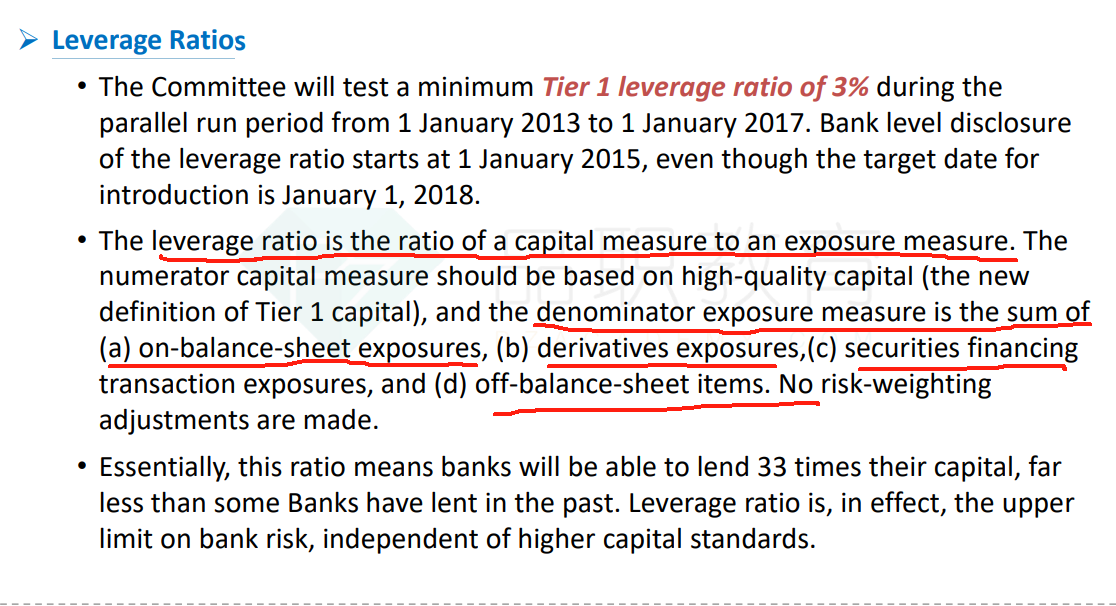

For Basel III purposes, the leverage ratio is

Tier 1 Capital/Total Exposure = 136/3,678 = 3.70%

老师,为什么是 total avarage exposure?这里的avarage 平均是啥意思?