NO.PZ2023102101000030

问题如下:

A regulatory analyst at a large multinational bank is examining

regulatory requirements the bank must comply with under the Basel Committee’s

FRTB guidelines. The analyst explores how the FRTB guidelines evolved from the

Basel I and Basel II.5 frameworks as well as the instructions for applying the

guidelines. Which of the following is correct regarding the FRTB?(Practice

Exam)

选项:

A.

While Basel I and Basel II.5 allowed market risk

to be calculated at the trading desk level, FRTB requires that market risk be

calculated on a firm-wide basis.

B.

While Basel I and Basel II.5 emphasized the use of a standardized approach to calculating market risk, FRTB encourages each bank to develop and rely on an internal models approach.

C.

FRTB standardizes the liquidity horizon used for

all risk factors in the market risk capital calculation as 10 days, rather than

the different horizons used in Basel I and Basel II.5.

D.

FRTB requires that the stressed ES measure be used in determining market risk capital, rather than the VaR and stressed VaR measures that were used in Basel I and Basel II.5, respectively.

解释:

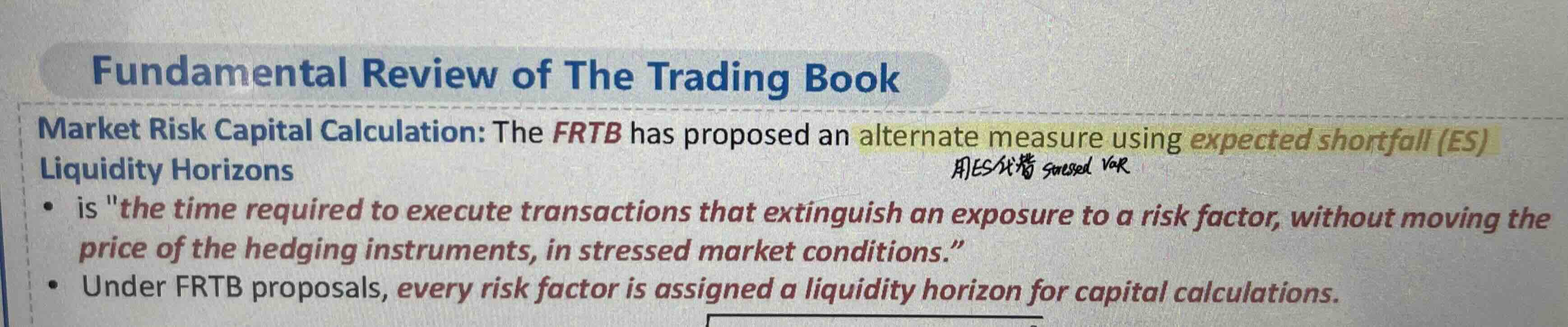

D is correct. The

Basel committee has moved from the VaR and stressed VaR measures used in Basel

I and Basel II.5 to the stressed ES measure used in FRTB.

A is incorrect. The

reasoning is reversed. FRTB allows market risk to be calculated at the trading

desk level.

B is incorrect. The

FRTB is a culmination of Basel committee efforts to place less reliance on

internal models approach. Under FRTB, all banks must calculate market risk

capital using a standardized approach, even if they have been approved to use

an internal models approach.

C is incorrect. The FRTB introduces 5 different

liquidity horizons that are better matched to the liquidity horizons of

different risk factors than the earlier 10-day horizons used in Basel I and

Basel II.5.

老师,咱们基础课和强化课都提到,ES只是stressed VaR的一种补充,不是取代,但是D的描述就是完全不用VaR了,而且ES是说把VaR和stressed VaR都取代了,为啥对啊?