同学你好,本题就是用

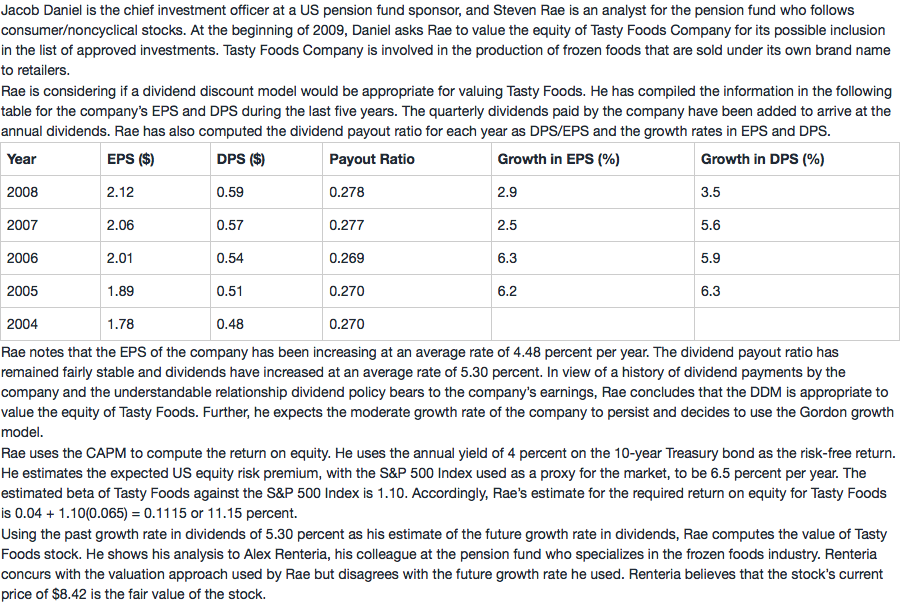

”Further, he expects the moderate growth rate of the company to persist and decides to use the Gordon growth model.

Rae uses the CAPM to compute the return on equity. He uses the annual yield of 4 percent on the 10-year Treasury bond as the risk-free return. He estimates the expected US equity risk premium, with the S&P 500 Index used as a proxy for the market, to be 6.5 percent per year. The estimated beta of Tasty Foods against the S&P 500 Index is 1.10. Accordingly, Rae’s estimate for the required return on equity for Tasty Foods is 0.04 + 1.10(0.065) = 0.1115 or 11.15 percent.

Using the past growth rate in dividends of 5.30 percent as his estimate of the future growth rate in dividends, Rae computes the value of Tasty Foods stock.“

这里的内容进行计算的

表格里给了08年的最新的分红,也就是D0 = 0.59,然后利用GGM和粉色部分的g = 5.3%,Re = 11.15%

答案就是V0=0.59*(1+5.3%)/(11.15%-5.3%)=10.62