NO.PZ202208260100000709

问题如下:

The Viswan Family Office (VFO) owns non-dividend-paying shares of Biomian Limited that are currently priced (S0) at INR 295 per share. VFO’s CIO is considering an offer to sell shares at a forward price (F0(T)) of INR 300.84 per share in six months based on a risk-free rate of 4%. You have been asked to advise on the purchase of a put option or the sale of a call option with an exercise price (X) equal to the forward price (F0(T)) as alternatives to a forward share sale.

VFO is concerned about the potential for increasing interest rates in the future. Which of the following statements provides the most correct description as to how rising rates after entering into the two option strategies would affect the option valuations?

选项:

A.Rising risk-free rates would make the selling a call option strategy more advantageous to VFO because call options increase in value with higher risk-free rates. B.Rising risk-free rates would make the buying a put option strategy more advantageous to VFO because the company locks in the put option premium at lower interest rates. C.Rising risk-free rates are a negative for both option strategies.解释:

C is correct. Because both option strategies (buy a put or sell a call) are short strategies, VFO is delaying cash inflows so higher risk-free rates are negative. A is incorrect as this statement describes the value effect from buying a call option, not from selling. B is incorrect as the locked-in premium will decline after rising risk-free rates.

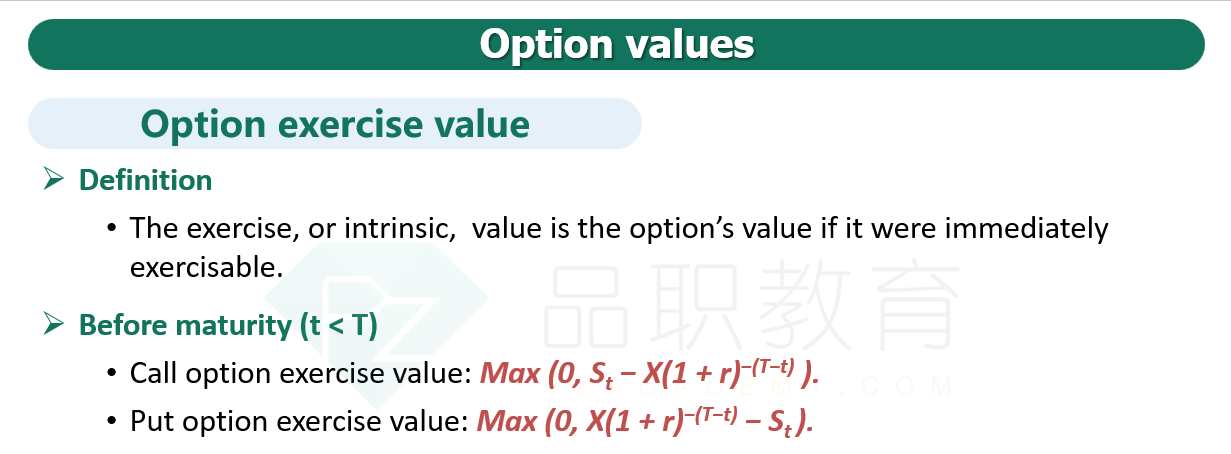

从期权费的角度考虑,put的value会降低,所以支付期权费会减少;call的value会增加,但因为我们是sell call,所以收到的期权费也会升高,所以两者都应该是有利的呀;

如果从内在价值来说,我们持有put,他的价值降低;而call也是价值降低,对我们来说就是不利的。

不太明白应该如何去考虑呢,麻烦老师解答一下