NO.PZ2023102101000005

问题如下:

Each of the following is true about the internal

ratings-based (IRB) approaches to credit risk under Basel III, except which is

false?

选项:

A.

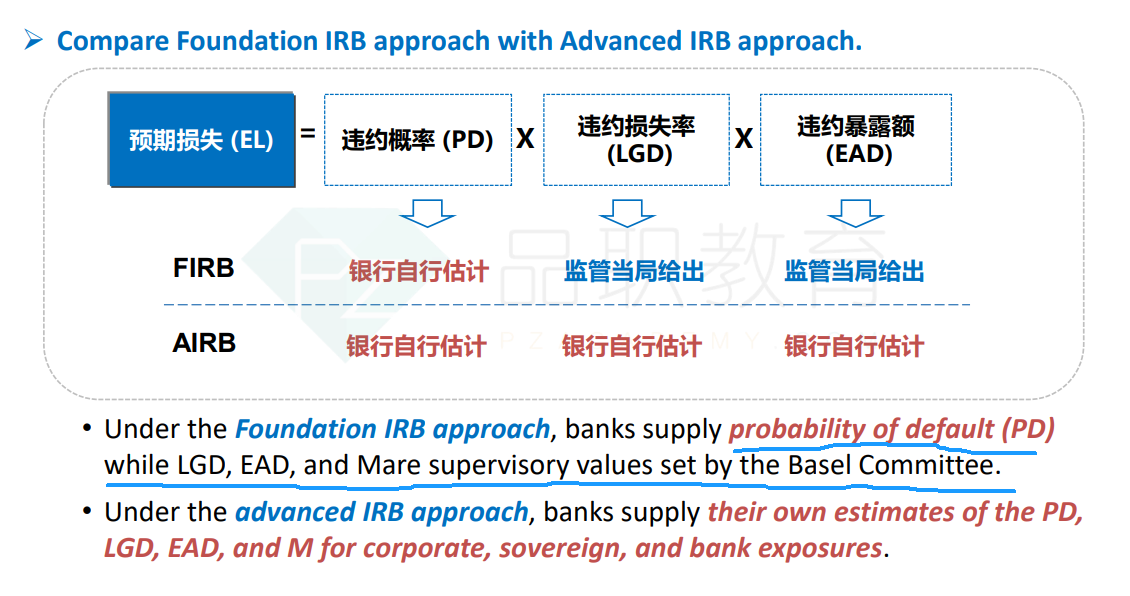

In both approaches (FIRB and AIRB) each debt is issuer

is assigned a probability of default (PD) according to the bank’s internal

rating system

B.

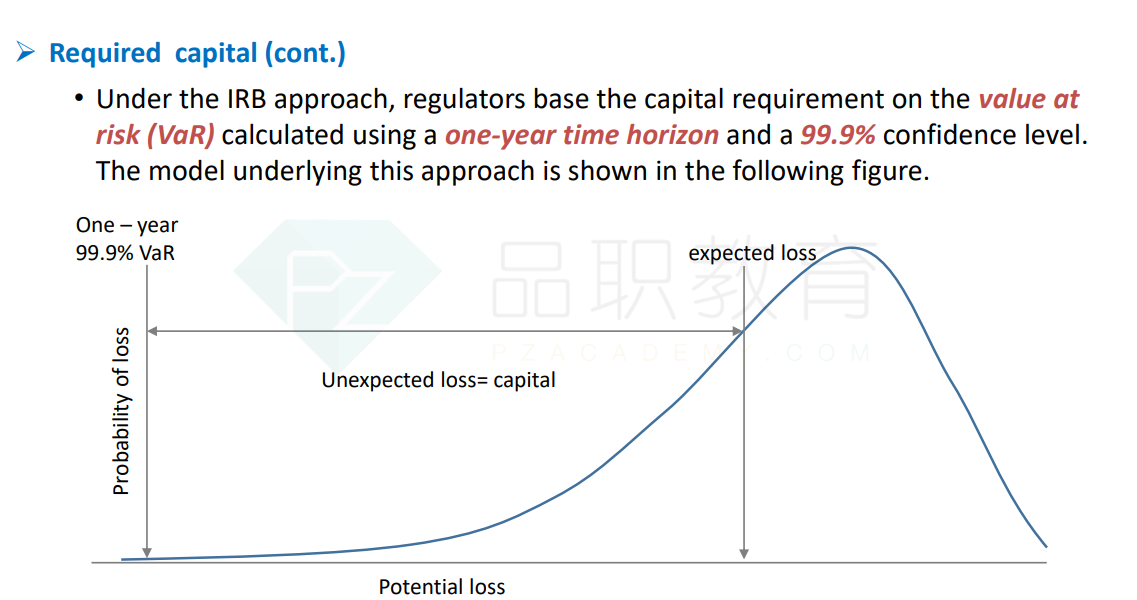

In both approaches (FIRB and AIRB) the goal is to compute a credit risk charge that supports unexpected credit losses at a 99.9% confidence level over a one-year horizon

C.

In both approaches (FIRB and AIRB) the credit risk function is a multi-factor(APT) model which does not assume the credit portfolio is diversified

D.

In Foundation IRB approach, only default probability (PD) is assigned by the bank’s internal model; but exposure at default (EAD) is based on credit conversion factors (CCF), LGD is set to either 45% or 75%, and residual maturity is generally fixed at 2.5 years

解释:

Perhaps the critical assumption of the

internal ratings-based models is so-called portfolio invariance: individual

exposure charges do not depend on the rest of the credit portfolio, but rather

depend on their presumed correlation to a single factor. This is achieved with

the dubious assumption of a well-diversified (“infinitely granular”) portfolio

and exposure to a single common risk factor (the asymptotic risk factor, ASRF).

In regard to (A), (B) and (D), each is true.

老师,IRB法,之所以叫内部评级,是因为银行自己算的PD是依据内部评级结果计算?基础法是怎么计算的呢?如果只估计PD,那是预期损失,VaR减去预期损失后的部分才是资本金,这块儿在基础法是咋个过程?