NO.PZ2024021801000076

问题如下:

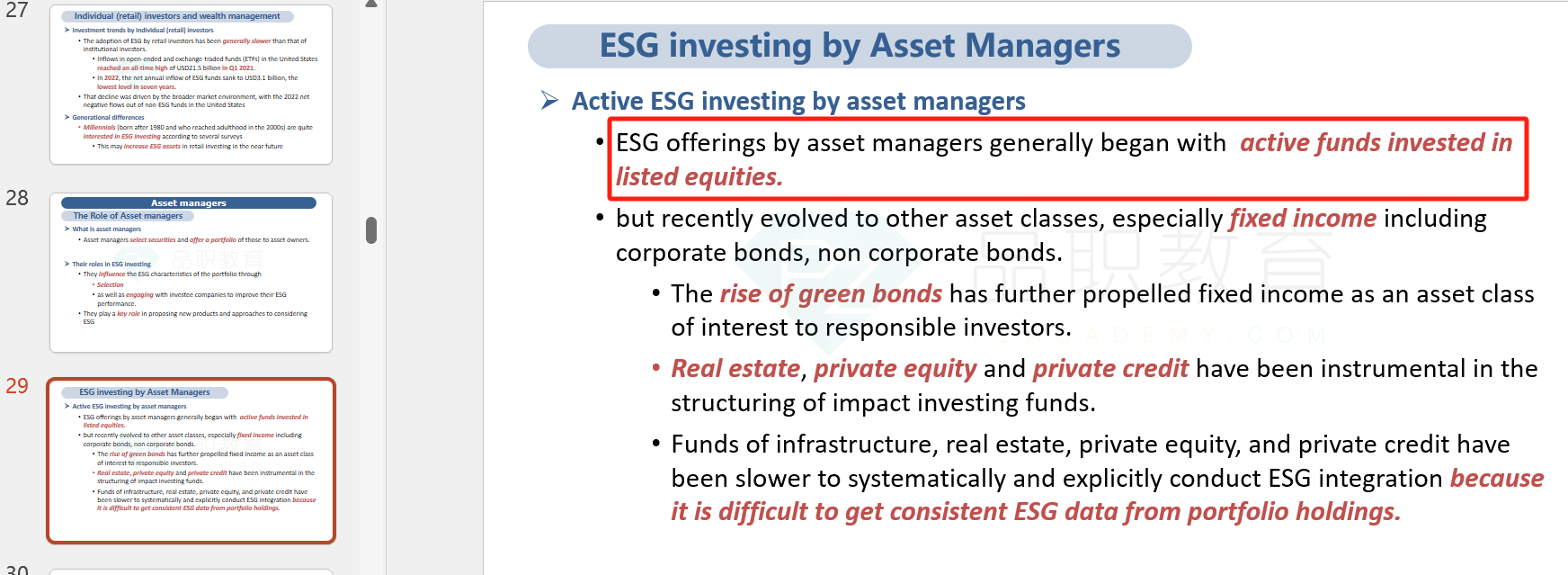

Which of the following was the first to integrate ESG?选项:

A.Equity indices

B.Passive equity funds

C.Active-listed equity investments

解释:

A. Incorrect because ESG offerings by asset managers generally began with active-listed equities, but recently evolved to other asset classes. The offering of indices and passive funds with ESG integration by asset managers started 20 years after that of active investments.

B. Incorrect because ESG offerings by asset managers generally began with active-listed equities, but recently evolved to other asset classes. The offering of indices and passive funds with ESG integration by asset managers started 20 years after that of active investments.

C. Correct because ESG offerings by asset managers generally began with active-listed equities, but recently evolved to other asset classes. The offering of indices and passive funds with ESG integration by asset managers started 20 years after that of active investments.

请问equity和fund的区别是什么?