NO.PZ2023010903000070

问题如下:

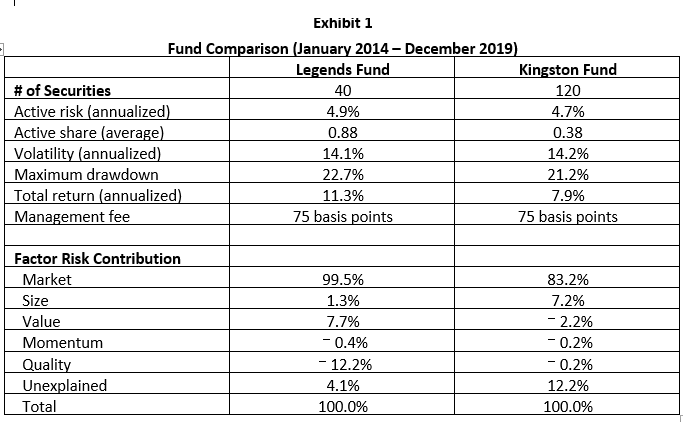

After answering a few additional questions, Swanson provides Rizzitano with a one-page document comparing the Legends Fund to the Kingston Fund. The information in this document is displayed in Exhibit 1. Swanson notes that the Kingston Fund is the Legends Fund's closest competitor and employs a very similar investment philosophy focused on quality. Swanson tells Rizzitano that the document demonstrates that the Legends Fund has a much more efficient portfolio structure than the Kingston Fund.

Identify two fund characteristics in Exhibit 1 that support Swanson's comment regarding the Legends Fund's relatively efficient portfolio structure.

选项:

解释:

Answer:

An efficient, well-constructed portfolio should have 1) risk exposures that align with investor expectations, and 2) low idiosyncratic(unexplained) risk relative to total risk.

The investment philosophies of both the Legends Fund and the Kingston Fund focus on the quality risk factor. However, the factor risk contributions provided in Exhibit 1 suggest that quality is a significant factor exposure for the Legends Fund at-12.2% but is insignificant for the Kingston Fund at -0.2%. This supports Swanson's statement.

In addition, the amount of idiosyncratic risk is much higher as a percentage of total risk for the Kingston Fund, at 12.2%, versus just 4.2% for the Legends Fund. This also supports Swanson's statement.

- the volatility of Legends Fund and Kingston Fund are similar, which are 14.1% and 14.2% respectively, but the total return for Legends Fund(11.3%) is higher than Kingston Fund(7.9%).

- the active risk of Legends Fund and Kingston Fund are similar, which are 4.9% and 4.7% respectively, but the active share for Legend Fund (0.88) is higher than Kingston Fund(0.38). The higher numbers of holding securities in Legends Fund than those in Kingston Fund demonstrated that conclusion as well.

老师先帮忙看下答案,谢谢

还有一个问题,我看答案有一点点疑惑:

衡量是否是一个好的组合有四个衡量纬度,简单总结就是一以贯之、说到做到、有效率承担风险还有便宜,我看这个问题问的是efficiency,所以仅从第三点进行回答,但是答案好像也兼顾了是否是promised structure这个方面,请问考试的时候应该从哪个角度回答呢?