NO.PZ2023010903000066

问题如下:

Before hiring Välimaa, the Missipina Foundation’s portfolio had been managed internally.

Välimaa reviews a memo from Missipina’s investment committee that summarizes the previous internal manager’s approach to portfolio construction:

“The manager used a growth at a reasonable price (GARP) investment approach to identify attractively priced stocks. He emphasized understanding a firm’s governance structure, management quality, business model/competitive landscape, and environmental, social, and governance (ESG)-related attributes. The portfolio generally held less than 60 stocks, significantly less than the number of stocks in the benchmark and the portfolio was not well diversified.”

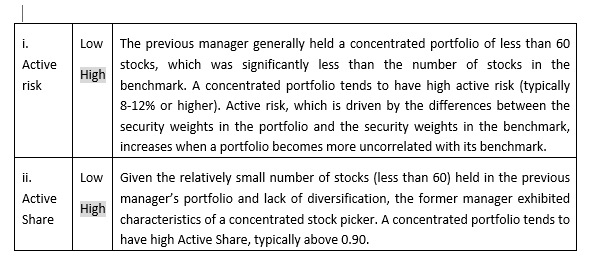

Determine, based solely on the memo’s content, whether the former manager’s portfolio would most likely be characterized as having high or low:

i. Active risk

ii. Active Share

Justify each response.

选项:

解释:

- The portfolio has high active risk and high active share.

- Given that the portfolio held less than 60 stocks, significantly less than the number of stocks in the benchmark, the portfolio would have high idiosyncratic risk. So the active share is high.

- Given that the portfolio was not well diversified, the portfolio would have high net sector exposures, which means the correlation between the sectors in the portfolio and the sectors in the benchmark is low. So the active risk is high as well.

老师帮忙看下答案,谢谢