NO.PZ202301280200000602

问题如下:

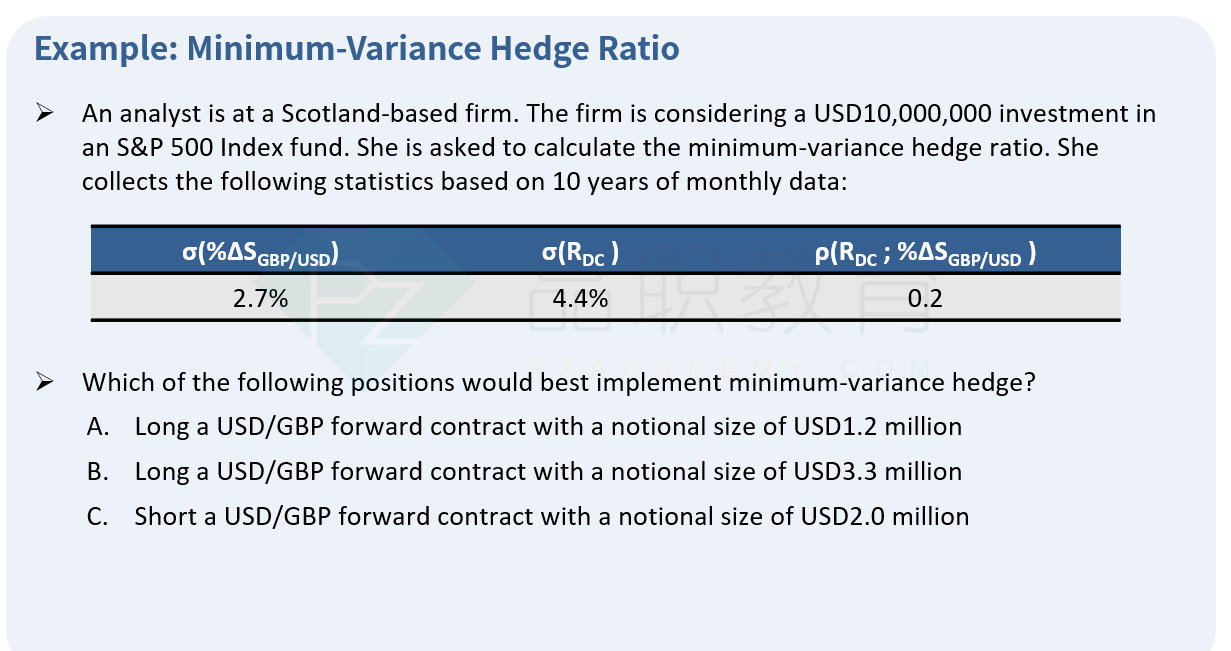

Which of the following positions would best implement

minimum-variance hedge against CTA exposure?

选项:

A.

Short a USD/CTA forward contract with a notional size

of CTA 42.82 million

B.

Long an CTA/USD forward contract with a notional size

of CTA 27.14 million

C.

Long a USD/CTA forward contract with a notional size

of USD 27.14 million

解释:

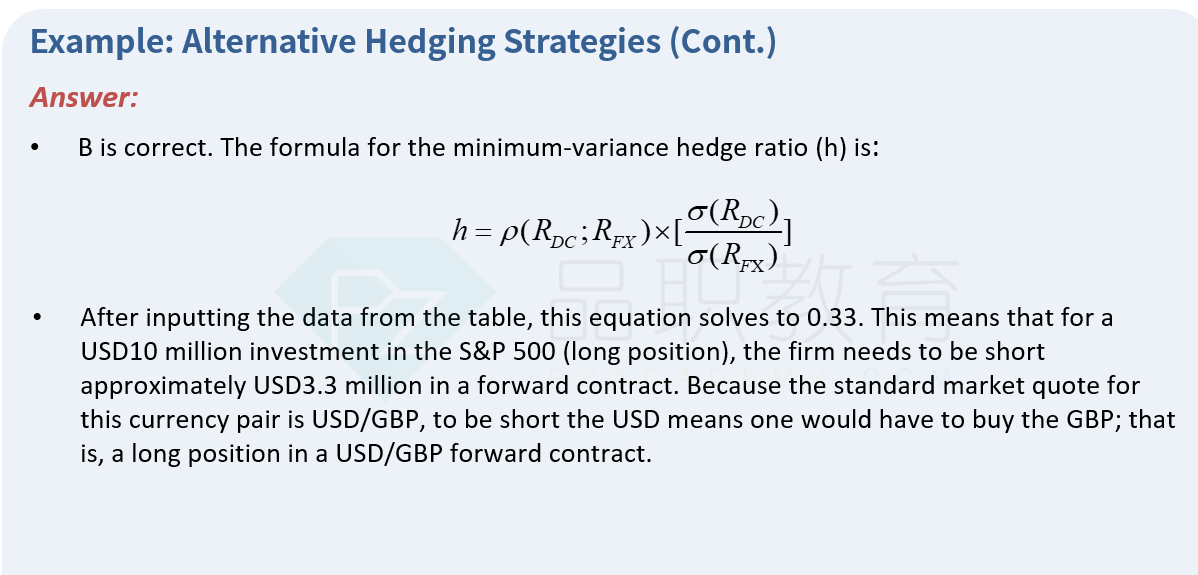

Correct

Answer: B

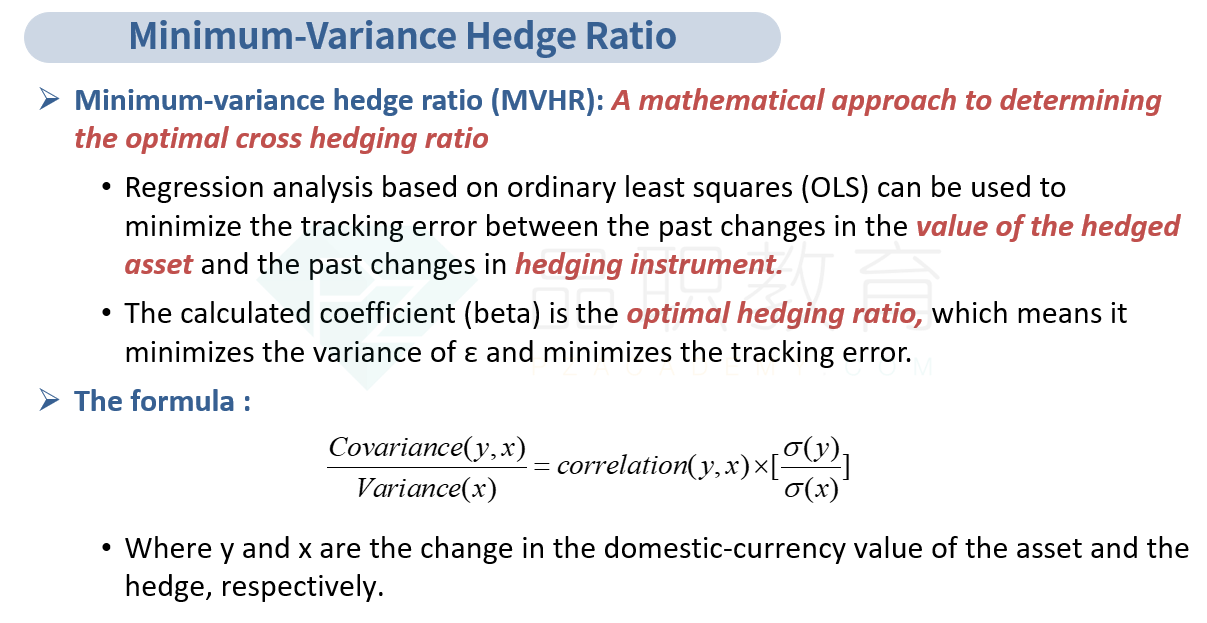

Minimum-Variance Hedge

Ratio.

h = ρ (RUSD;

RUSD/CTA) × {σ(RUSD) / σ(RUSD/CTA)} = 0.53 ×

(2.45%/7.47%) = 0.174

Hedge position =

0.174 × CTA 156 million = CTA 27.14 million

Yang has a holding

of CTA 156 million assets. The standard market quote for this currency pair is

CTA/USD. To protect the position against the risk of exchange rate

fluctuations, hedge using a short position in CTA, and long position in USD in

a forward contract, hence long CTA/USD currency pair.

The minimum

variance hedge is to long an CTA/USD forward contract with a notional size of

CTA 27.14 million.

请问一下这个相关的知识点在哪里可以找到? 谢谢!