NO.PZ2023090507000040

问题如下:

The optimal capital structure is determined where the benefit of the debt tax shield is offset by the cost of financial distress under the:

选项:

A.

free cash flow hypothesis.

B.

static trade-off theory of capital structure.

C.

pecking order theory.

解释:

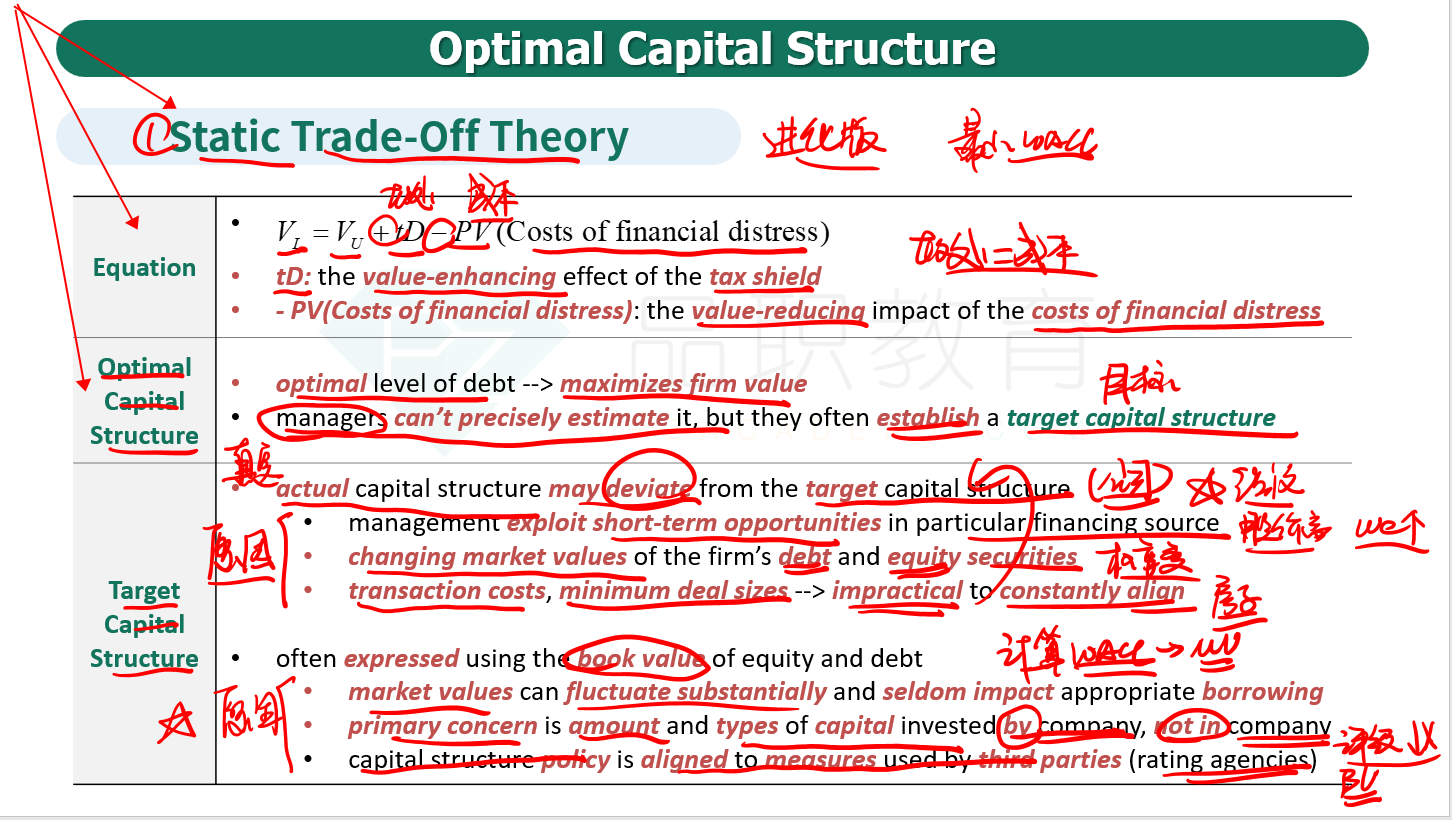

B is correct. The static trade-off theory of capital structure incorporates both the value-enhancing effect of the tax shield and the value-reducing impact of the costs of financial distress. At the optimal level of debt, the financial distress cost equals the tax benefit of debt.

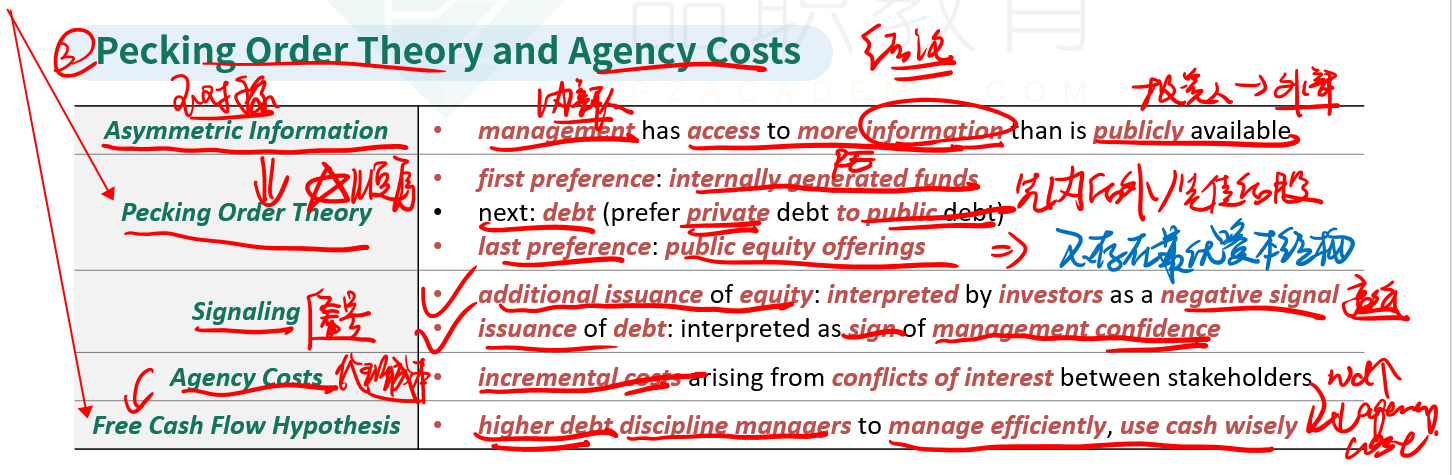

The free cash flow hypothesis argues that higher debt levels discipline managers by forcing them to manage the company efficiently and use cash wisely so the company can make its interest and principal payments.

The pecking order theory states that firms use internally generated funds first because there are no floatation costs or negative signals. If more funds are needed, firms issue debt and only as a last resort will they issue equity. There is no optimal capital structure.

可以翻译一下嘛,这三个选项有什么区别