NO.PZ2023052301000088

问题如下:

The feature of a covered bond transaction most likely shared with both CDOs and non-mortgage ABS is its:

选项:

A.

specified LTV cutoff.

B.

multiple tranches for the cover pool.

C.

distinct maturity and settlement dates.

解释:

The correct answer is C. As illustrated by their respective term sheets, all three types of ABS transactions have timing milestones designating due dates for investments (settlement date) and the end of their terms (maturity date).

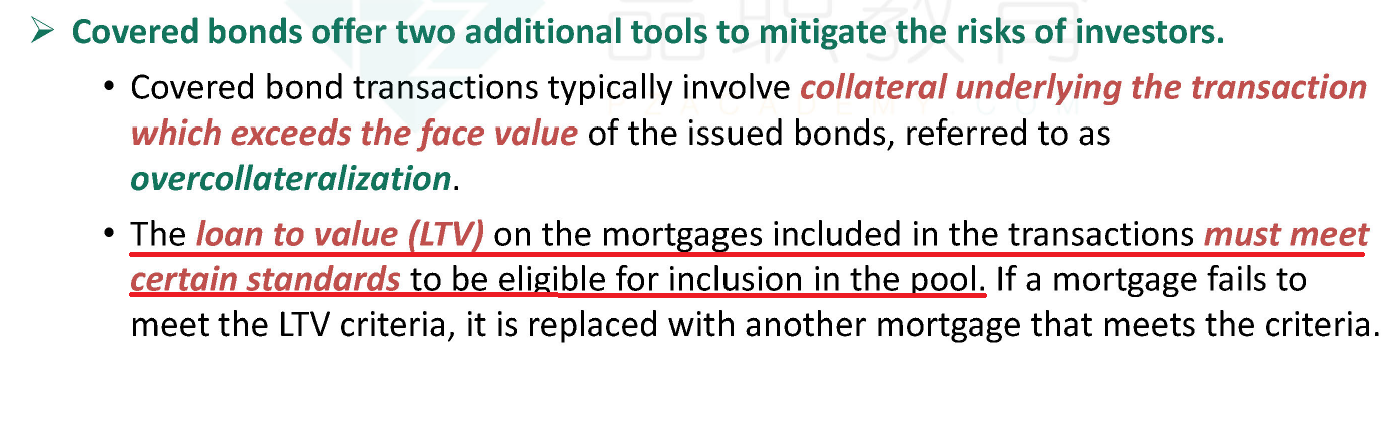

A is incorrect because in contrast to their non-amortizing counterparts, covered bonds are backed by a segregated pool of assets that typically consist of commercial or residential mortgages, for which an LTV cutoff is applicable.

B is incorrect because while other ABS often use credit tranching to create bond classes with different borrower default exposures, covered bonds usually consist of one bond class per cover pool.

LTV适用于什么呢,CDO中也是mortgage也可以用LTV呀