NO.PZ201812020100000205

问题如下:

Celia is chief investment officer for the Topanga Investors Fund, which invests in equities and fixed income. The clients in the fund are all taxable investors. The fixed-income allocation includes a domestic (US) bond portfolio and an externally managed global bond portfolio.

The

domestic bond portfolio has a total return mandate, which specifies a long-term

return objective of 25 basis points (bps) over the benchmark index. Relative to

the benchmark, small deviations in sector weightings are permitted, such risk

factors as duration must closely match, and tracking error is expected to be

less than 50 bps per year.

The objectives for the domestic bond portfolio include the ability to fund future liabilities, protect interest income from short-term inflation, and minimize the correlation with the fund’s equity portfolio. The correlation between the fund’s domestic bond portfolio and equity portfolio is currently 0.14. Celia plans to reduce the fund’s equity allocation and increase the allocation to the domestic bond portfolio. She reviews two possible investment strategies.

- Strategy 1 Purchase AAA rated fixed-coupon corporate bonds with a modified duration of two years and a correlation coefficient with the equity portfolio of -0.15.

- Strategy 2 Purchase US government agency floating-coupon bonds with a modified duration of one month and a correlation coefficient with the equity portfolio of -0.10.

Dan recommends Treasuries from the existing portfolio that he believes are over-valued and will generate capital gains. Celia asks Dan why he chose only overvalued bonds with capital gains and did not include any bonds with capital losses. Dan responds with two statements.

- Statement 1 Taxable investors should prioritize selling overvalued bonds and always sell them before selling bonds that are viewed as fairly valued or undervalued.

- Statement 2 Taxable investors should never intentionally realize capital losses.

Celia

contemplates adding a new manager to the global bond portfolio. She reviews

three proposals and determines that each manager uses the same index as its

benchmark but pursues a different total return approach, as presented in

Exhibit 3.

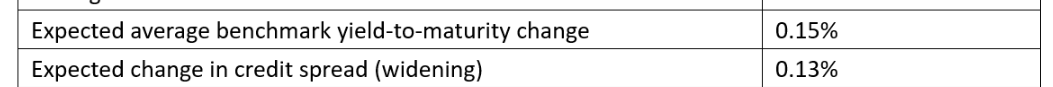

Based on Exhibit 2, the total expected return of the fund’s global bond portfolio is closest to:

选项:

A.0.90%.

B.1.66%.

C.3.76%.

解释:

B is correct. The total expected return is calculated as follows:

Total

expected return = Rolling yield

+/–

E(Change in price based on investor’s benchmark yield view)

+/–

E(Change in price due to investor’s view of credit spread)

+/–

E(Currency gains or losses)

where Rolling yield = Coupon income + Rolldown return.