NO.PZ202411210200001201

问题如下:

Washington’s utility function is best described as:

选项:

A.risk averse.

B.risk neutral.

C.risk seeking.

解释:

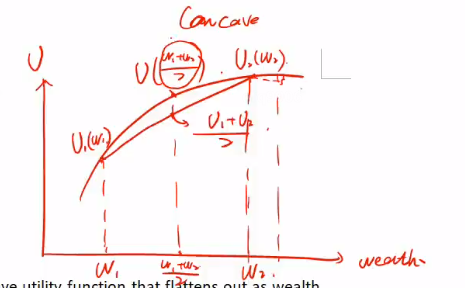

A is correct. A risk-averse investor will have a concave utility function that flattens out as wealth increases so that each additional unit of wealth gives rise to a smaller increment in utility than the prior unit of wealth. Washington has reached a stage where each new increment of wealth seems less important than it did previously.

解析为何这么解释呢?请问这道题该怎么判断合适 考试时候