NO.PZ2024061801000098

问题如下:

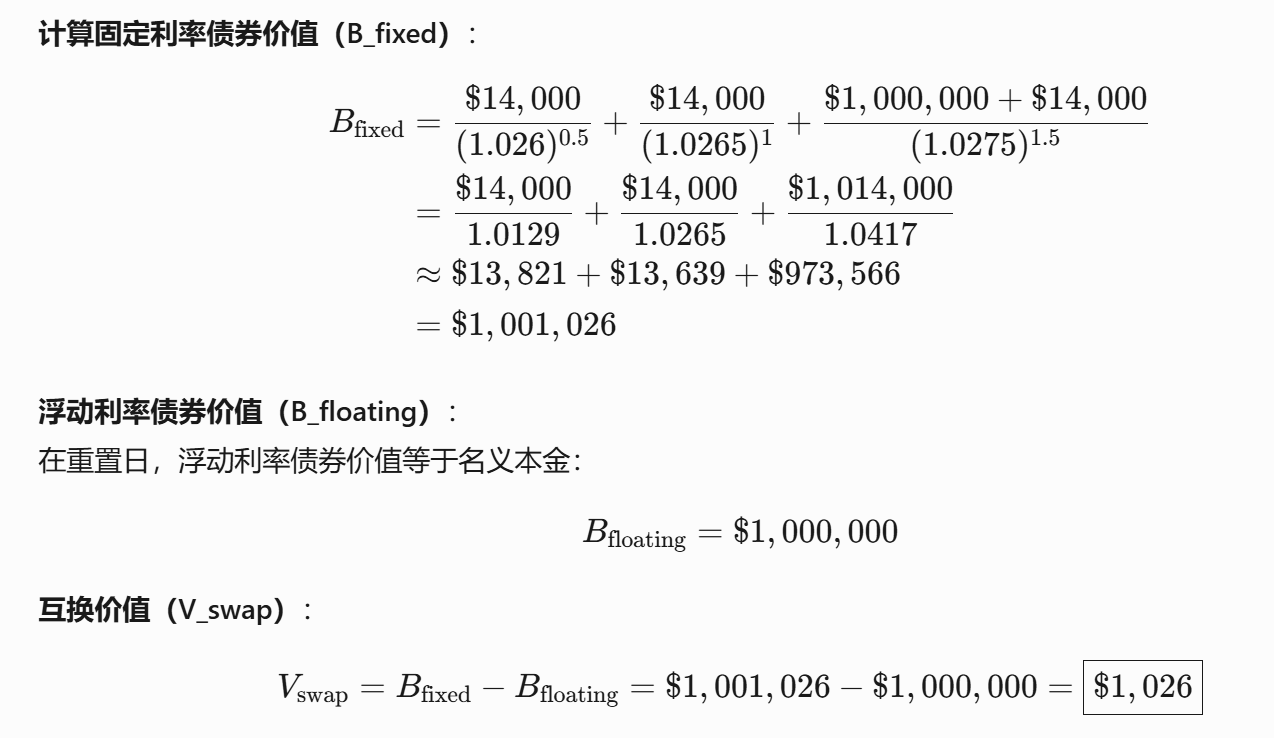

Consider the following information:

$1 million notional value, semiannual, 18-month maturity.

Spot SOFR rates: 6 months, 2.6%; 12 months, 2.65%; 18 months, 2.75%.

The fixed rate is 2.8%, with semiannual payments.

Which of the following amounts is closest to the value of the swap to the floating rate payer, assuming that it is currently the floating-rate reset date?

选项:

A.

−$1,026.

B.

$1,026.

C.

−$12,416.

D.

$12,416.

解释:

老师,请问下,半年,用(1+2。6%/2)和用(1+2。6%)^2区别