NO.PZ202301040900001201

问题如下:

R-Cubed is a private foundation

dedicated to the advancement of resource recycling and environmental solutions.

Although the foundation is headquartered in Cambridge, Massachusetts, its

headquarters’ staff is minimal. Most of its employees are located in its

offices in Tokyo, Japan, and Dublin, Ireland.

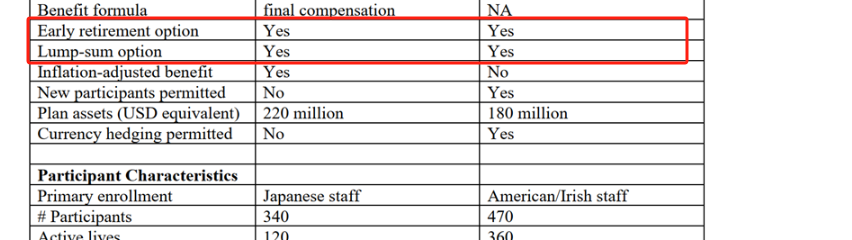

R-Cubed maintains

two separate and distinct retirement plans for its workers: a traditional

defined benefit pension plan for its Japanese staff and a defined contribution

plan for its American and Irish staffs. A summary of high-level characteristics

for each plan are provided in Exhibit 1. The defined benefit pension plan is

frozen, with no new participants permitted to join. R-Cubed has shifted all

future hiring to its Dublin office.

R-Cubed

contributes 7% of compensation to the accounts of new participants in the

defined contribution plan, increasing its contribution to 11% of compensation

for employees who have been with the company for at least five years. Employees

are permitted to contribute up to 16% of their compensation to the plan on a

voluntary basis.

(1) Contrast the time horizon and liquidity constraints of the R-Cubed pension and defined contribution plans.

选项:

解释:

Time Horizon

While both retirement plans can be considered long-term, the time horizon of the defined benefit pension plan is shorter than that of the defined contribution plan because of its frozen status.

No new participants will be joining the pension plan and it will be wound down over time as existing participants and their beneficiaries die.

Liquidity Constraints

The defined benefit pension plan has a greater liquidity constraint due to its older workforce and the fact that the benefit will be paid out over the indeterminate lives of the participants and their beneficiaries.

The possibility of early retirement and lump-sum payouts amplifies this situation.

Further, the pension plan’s benefits are indexed to inflation, increasing the magnitude of benefit payouts going forward.

答案说的Lump-sum和Early retirement也是造成DB流动性需求更高的原因,但我看DB和DC都受到这个的影响啊,所以不应该作为原因之一吧?