NO.PZ2024121001000024

问题如下:

Which of the following is a significant advantage for GPs in receiving carried interest compared to other forms of compensation?

选项:

A.It is taxed at a higher rate, providing more tax revenue for the government.

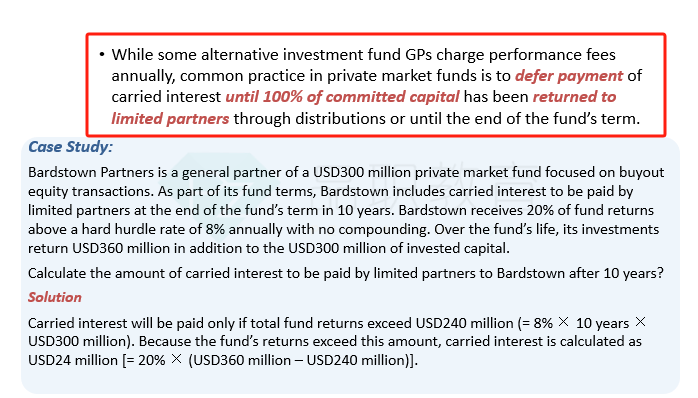

B.It is deferred until the end of the investment period and may be treated as a long-term capital gain.

C.It is based solely on the performance of individual investments rather than the overall fund.

解释:

对于普通合伙人(GPs)而言,收取附带权益(carried interest)相较于其他形式补偿的一个显著优势是,其支付通常会递延至投资期结束,并且在某些司法管辖区可能被视为长期资本收益,从而享受更有利的税收待遇。选项 A 错误,附带权益在一些地区(如美国和英国)通常被视为资本收益收入,税率相对较低;选项 C 错误,附带权益是基于基金整体回报,而非单个投资的表现。

这个费用不需要每年交吗