NO.PZ201601050100001606

问题如下:

Anneke Ngoc is an analyst who works for an international bank, where she advises

high-net-worth clients on option strategies. Ngoc prepares for a meeting with a US-based client, Mani Ahlim.

Ngoc notes that Ahlim recently inherited an account containing a large Brazilian

real (BRL) cash balance. Ahlim intends to use the inherited funds to purchase a vacation home in the United States with an expected purchase price of US$750,000 in six

months. Ahlim is concerned that the Brazilian real will weaken against the US dollar

over the next six months. Ngoc considers potential hedge strategies to reduce the risk

of a possible adverse currency movement over this time period.

Ahlim holds shares of Pselftarô Ltd. (PSÔL), which has a current share price of $37.41. Ahlim is bullish on PSÔL in the long term. He would like to add to his long position but is concerned about a moderate price decline after the quarterly earnings announcement next month, in April. Ngoc recommends a protective put position with a strike price of $35 using May options and a $40/$50 bull call spread using December options. Ngoc gathers selected PSÔL option prices for May and December, which are presented in Exhibit 1.

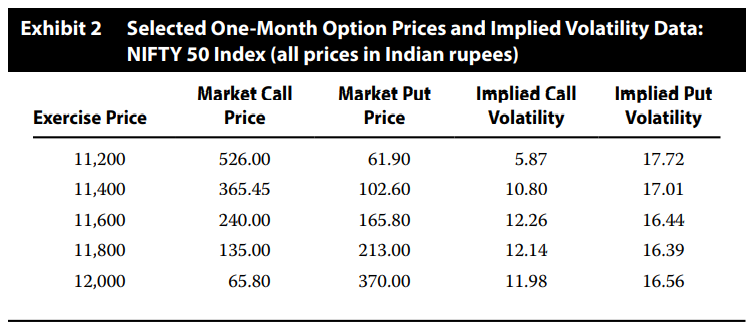

Ahlim also expresses interest in trading options on India’s NIFTY 50 (National Stock Exchange Fifty) Index. Ngoc gathers selected one-month option prices and implied volatility data, which are presented in Exhibit 2. India’s NIFTY 50 Index is currently trading at a level of 11,610.

Ngoc reviews a research report that includes a one-month forecast of the NIFTY 50 Index. The report’s conclusions are presented in Exhibit 3.

Based on these conclusions, Ngoc considers various NIFTY 50 Index option

strategies for Ahlim.

Based on Exhibit 2, the NIFTY 50 Index implied volatility data most likely indicate a:

选项:

A.risk reversal.

volatility skew.

volatility smile.

解释:

B is correct.

When the implied volatility decreases for OTM (out-of-the-money)

calls relative to ATM (at-the-money) calls and increases for OTM puts relative

to ATM puts, a volatility skew exists. Put volatility is higher, rising from 16.44

ATM to 17.72 OTM, likely because of the higher demand for puts to hedge

positions in the index against downside risk. Call volatility decreases from 12.26

for ATM calls to 11.98 for OTM calls since calls do not offer this valuable portfolio insurance.

A is incorrect because a risk reversal is a delta-hedged trading strategy seeking

to profit from a change in the relative volatility of calls and puts.

C is incorrect because a volatility smile exists when both call and put volatilities, not just put volatilities, are higher OTM than ATM.

中文解析:

印度的NIFTY 50指数当前的交易水平为11610点,接近表格2中的11,600。因此可以认为执行价格为11,6000的期权是处在ATM状态的期权。

以看跌期权为例,执行价格高于11600的是ITM的期权;执行价格低于11600的是OTM的期权。

Volatility smile的图形显示的是不论是OTM 的put还是ITM的put,其隐含波动率都是高于ATM状态时的隐含波动率的。

Volatility skew的图形则显示的是OTM的put隐含波动率高于ATM状态的put;ITM的put其隐含波动率会略微低于ATM状态的put。

因此根据表格可知,这符合volatility skew的形态。

Call Option:OTM < ATM < ITM,但上图完全是反过来的呀